SEOUL, February 12 (AJP) - The National Tax Service has opened investigations into 46 businesses suspected of tax evasion, including 24 wedding service providers, 12 postnatal care centers, and 10 English-language kindergartens, the office said Tuesday.

The probe targets businesses that allegedly concealed income by directing customers to make additional payments beyond basic contract fees through multiple accounts held under borrowed names. One prominent photo studio was found to have used unreported earnings to acquire real estate and stocks worth 10 billion won.

“Some wedding service providers registered their businesses under children studying abroad and used the proceeds to purchase real estate in their children's names,” an NTS official said.

Postnatal care centers, which charge upwards of 10 million won for services, reportedly offered discounts to clients who agreed not to request cash receipts.

Some facilities recorded artificial losses while acquiring high-value real estate, with one charging double the market rate for rent to finance overseas travel and luxury purchases.

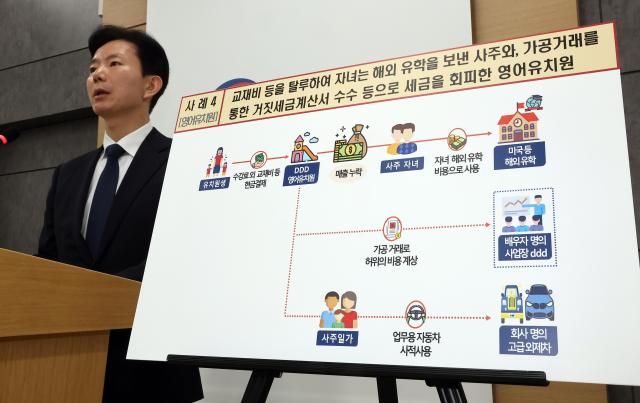

Private English-language kindergartens were found to have received unreported cash payments for textbooks, after-school programs, and educational materials. Some institutions established family-run textbook supply companies to fabricate expenses and reduce tax liabilities.

The businesses under investigation, primarily located in Seoul and the surrounding metropolitan area, are suspected of evading taxes on a combined income of 200 billion won.

Copyright ⓒ Aju Press All rights reserved.