SEOUL, April 10 (AJP) - South Korea's semiconductor companies are navigating a new wave of uncertainty as U.S. President Donald Trump escalates his campaign against federal subsidies for the chipmaking industry, a shift in U.S. industrial policy that could ripple through the global technology supply chain.

In a March 4 address to Congress, Trump called for the repeal of the CHIPS Act, a landmark 2022 bipartisan initiative that earmarked $52.7 billion to revitalize domestic semiconductor manufacturing.

The law was widely seen as a cornerstone of the Trump administration's strategy to reduce reliance on foreign chipmakers and bolster America's technological edge.

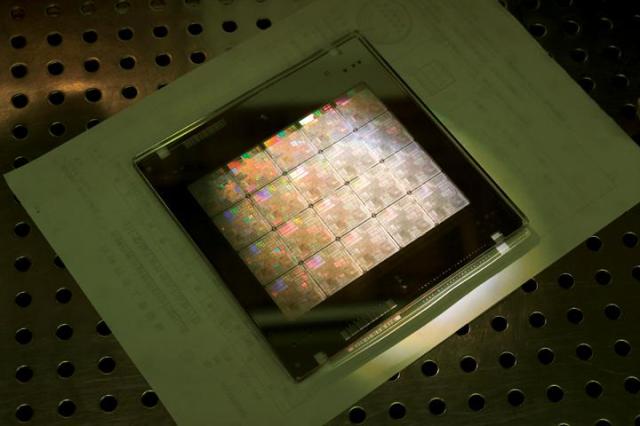

The changing U.S. policy reverberated across the global chipmaking industry just as Taiwan Semiconductor Manufacturing Company, or TSMC, unveiled a $100 billion investment in its Arizona operations. Days later, Trump intensified his criticism, asserting that semiconductor firms "do not need the money," and claimed credit for TSMC's U.S. expansion.

"All I did was say, if you don't build your plant here, you're going to pay a big tax," Trump said on April 8.

His rhetoric coincided with a new round of trade pressure. On April 3, the Trump team announced sweeping 25 percent "reciprocal" tariffs on select imports from South Korea, though the semiconductor industry narrowly avoided immediate inclusion. The White House later paused the levies for 90 days, leaving in place a 10 percent baseline tariff.

However, major South Korean exports — including automobiles and auto parts — have already been subject to full 25 percent tariffs since March 26, raising concerns about indirect consequences for the chip sector.

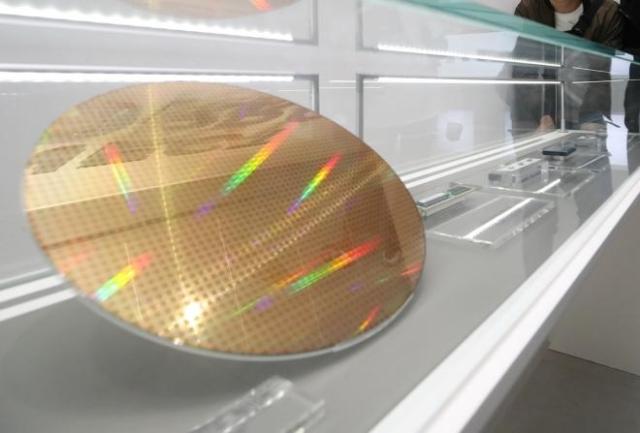

For Samsung Electronics, the crown jewel of South Korea's tech industry, the stakes are mounting. Its foundry division held just 8.1 percent of the global market in the fourth quarter of 2024, compared to TSMC's dominant 67.1 percent share.

On April 3, TSMC reportedly met with Intel to discuss a joint venture, a move that industry analysts say may have been encouraged by Trump as part of efforts to rejuvenate the domestic chip industry. TSMC's U.S. momentum comes as it faces a 34 percent tariff at home in Taiwan and scrutiny over alleged ties to Chinese telecommunications giant Huawei.

"Samsung has reduced its foundry facility investment budget to less than 5 trillion won this year, about half of last year's amount, due to declining factory utilization," said an industry source.

The official added that a potential TSMC-Intel alliance could further complicate Samsung's expansion plans in the United States, particularly as progress on its Taylor, Texas, facility has reportedly slowed.

On March 31, the White House introduced a new "United States Investment Accelerator" tasked with overseeing the CHIPS program office and negotiating what it described as "better deals" than those under the current administration. Industry officials believe the initiative could foreshadow both stricter subsidy requirements and more robust investment mandates.

Adding to the uncertainty, Trump has repeatedly floated the possibility of a 25 percent tariff on semiconductor imports, most recently reaffirming the proposal on April 3, without offering a timeline. Meanwhile, U.S.-based GlobalFoundries and Taiwan's UMC — the fourth- and fifth-largest players in the foundry space — are reportedly exploring a strategic alliance that could challenge Samsung's second-place position.

SK hynix, another major South Korean chipmaker, is faring better in the short term.

The company is seeing robust demand for its high-bandwidth memory (HBM) products, a critical component in artificial intelligence applications and widely adopted by Nvidia. But even there, geopolitical undercurrents loom.

Some clients, anticipating future trade friction, have accelerated orders in recent months.

"The pull-in effect and declining inventories have created favorable conditions," said Lee Sang-rak, SK hynix's head of global sales and marketing, during a March 27 shareholder meeting. "But it is uncertain how long this will last."

Despite rising interest in the U.S. market, South Korea's chip exports to the United States accounted for just 7.5 percent of its total last year — far behind China (32.8 percent), Hong Kong (18.4 percent), and Taiwan (14.5 percent), according to data from the Korea International Trade Association.

Still, the prospect of sweeping U.S. tariffs has left many Korean executives and policymakers wary. Lee Jong-hwan, a professor of system semiconductor engineering at Sangmyung University, believes the impact may be less severe than feared.

"Korean and Chinese companies already dominate the general-purpose memory market," he said. "Tariffs will raise costs for U.S. buyers more than they will hurt Korean producers. And in the high-bandwidth memory market, Korean firms are already ahead."

Copyright ⓒ Aju Press All rights reserved.