[Yonhap News Photo]

SEOUL -- Samsung Electronics Co. reported Wednesday its net profit more than halved in the second quarter from a year earlier due to weak memory chip prices, but it expected a gradual recovery in demand down the road.

The net profit for the world's largest chip and smartphone maker came to 5.18 trillion won ($4.4 billion) in the April-June period, a 53.1 percent fall from a year earlier, the company said in a regulatory filing. Its operating profit plunged 55.6 percent on-year to 6.59 trillion won, and sales slipped 4 percent to 56.1 trillion won in the three-month period, the firm said.

The operating income for the second quarter was above market expectations of 6.07 trillion won, based on the survey conducted by Yonhap Infomax, the financial arm of Yonhap News Agency on 23 Korean brokerage houses. The sales estimate stood at 54 trillion won on average.

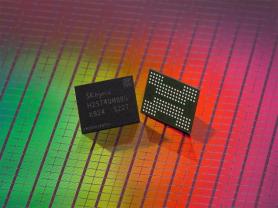

Samsung said the lower-than-expected memory chip prices weighed on its bottom line despite a slight recovery in demand in the second quarter. The semiconductor business posted 3.4 trillion won in operating profits in the second quarter, the lowest since the third quarter of 2016.

"The weakness and price declines in the memory chip market persisted as the effects of inventory adjustments by major data center customers in the previous quarters continued, despite a limited recovery in demand," Samsung said in a release.

The company expected demand for DRAMs used in servers and computers to pick up in the third quarter as data centers adjust their inventory levels and resume purchasing in the peak season. For NAND, mostly used in mobile devices, Samsung expected the market to gradually stabilize from the third quarter on rising demand for high-density products.

"In the second half, demand is expected to grow although the company sees volatility in the overall industry due to increased external uncertainties," the company said.

The Korean tech firm faces rising uncertainties on the trade front amid the prolonged trade war between the United States and China and more recently, Japan's export curbs on South Korea. Japan began adopting stricter export rules on some key materials needed for making chips on July 4 amid a diplomatic row over the issue of wartime forced labor.

Samsung is also preparing for Japan's decision to remove South Korea from a list of trusted buyers as early as this week, which would affect a broader range of high-tech materials.

"Even though the current Japanese measures don't ban exports of the materials, the new export regulations add burden (on the company) and it is hard to predict how they will be adopted," Robert Yi, executive vice president for investor relations, said in a conference call. "Company executives are preparing various measures to minimize its negative impact on the company."

Although spot prices of memory chips surged in the weeks following the Japanese measures, Samsung said it is not yet clear whether the recent trend can drive up contract prices with its customers, adding that it is not considering a memory chip production cut at the moment.

"A combination of various internal and external factors seems to have affected the spot prices, including the seasonality and concerns over future supplies following the Japanese measures," Yi said. "But it is hard to conclude whether it would affect the long-term contract prices of memory chips."

A spot price is the price currently traded on the market, while contract prices are negotiated as monthly or quarterly deals.

Market researcher DRAMeXchange, a division of TrendForce, predicted contract prices for major DRAM products to fall between 10 and 15 percent in the July-September period, due to high inventory levels at major suppliers and downbeat smartphone production. "The effects to arise from the Japan-South Korea incident will be limited in range, and will not pose too much of a problem to shipments hereafter," DRAMeXchange said in a report.

In contrast, the display division was a rare bright spot for the Korean tech firm, which has strength in the flexible OLED displays used in premium smartphones. Samsung said the display division, which logged operating losses in the first quarter, turned to the black with 750 billion won of operating earnings thanks to a one-time profit, without going into detail.

Market watchers speculated that the one-time profit was related to Apple's reimbursement of unrealized OLED display sales following weaker-than-expected sales of iPhones.

The mobile division also posted lackluster profits despite strong sales of budget smartphones, the Galaxy A series, in emerging markets. Although Samsung has upped the ante to invigorate the flattening smartphone market by releasing 5G smartphones in South Korea and the U.S., it failed to shore up its profits in the mobile division.

Samsung said it sold 8.3 million smartphones and 4 million tablets in the second quarter, predicting similar levels of shipments in the third quarter. To boost demand in the premium segment, the firm plans to release its latest phablet, the Galaxy Note 10 in August and Galaxy Fold in September. Samsung had planned to release the foldable device in April but delayed the release to September as it took time to fix some durability issues.

The network business showed solid results on the commercialization of 5G service in South Korea, the firm said, adding it will step up efforts to expand global presence in the 5G market. The consumer electronics division was boosted by strong sales of new appliance products, but profits from TVs fell slightly from a year earlier due to intensifying competition.

(Yonhap)

Copyright ⓒ Aju Press All rights reserved.