Power and the availability of land has become the preeminent consideration for hyperscale and colocation providers searching for sites to expand their portfolios. Global cloud service providers have expanded across primary, secondary, and tertiary markets, and locations that were initially not known for data center deployments now have hundreds of MW in the development pipeline.

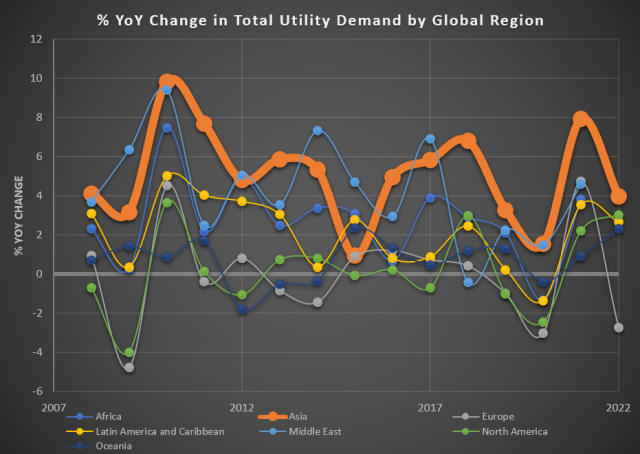

Developers around the world must satisfy a variety of criteria relating to government approval, power permissions, alongside pushback from local communities. Whilst not the same extent as other locations such as Singapore, which saw a moratorium put in place to maintain grid capability, power remains a critical consideration as total utility demand is on the rise. The graph below shows the Asia region has seen consistent positive YoY growth since 2008.

Asia has seen utility demand growth since 2008, unlike other global regions. Cushman & Wakefield Research, Ember Climate, Local Utility IRPs and Annual Reports (assuming baseline scenarios)

The general policy direction is for the decentralization of data centers away from Greater Seoul Area to regional areas for the establishment of purpose-led districts. However, this provides challenges for users whereby latency and proximity to end user are key considerations, and as such data centers operating in the metropolitan area will become crucial enabling tools for digital groups.

Mr. Yongsuk Choi, Chief Strategy Officer - Product & Infrastructure said: “Developing data centers in central Seoul is expected to face more challenges ahead as Korea Electric Power Corp. (KEPCO) is recently taking about 12 months, compared to 2-3 months, to confirm power supply, along with the announcement of a new policy restricting additional power supply in the Seoul metropolitan area.”

He added, “Recent legislations for power permit applications in South Korea have also introduced more stringent processes, requiring data centers to meet energy efficiency standards. This regulatory environment, while beneficial for long-term sustainability, presents challenges for securing timely power permits, particularly for AI-ready facilities that demand high energy consumption.”

As early as 2022, Empyrion Digital has successfully navigated these complexities by working closely with local authorities to secure a site in central Seoul with 40MW of power, and align our data center operations with Korea’s green energy policies. Through proactive collaboration and forward-thinking energy strategies such as the use of advanced cooling solutions, Empyrion Digital is well positioned to leverage our site location and power supply to meet the needs of hyperscale and enterprise customers in the AI era.

The enactment of the Special Act on Distributed Energy Activation on June 14 has intensified the competition for power acquisition in the South Korean market. In Seoul metropolitan area, the demand for data centers is surging, but power supply is limited, making it increasingly challenging to secure and allocate electricity. In central Seoul, securing data center sites with available power has become an even greater challenge. High land costs, limited available sites, and complaints from residents who view data centers as undesirable facilities have made new data center developments more difficult.

With this limited supply, companies are likely to explore alternatives in suburban or other regions. Supply of Seoul-based data centers is to become tighter, and we anticipate demand for space within these facilities is to rise in the upcoming years, especially with the forecasted rise of AI, power and land constraints, plus high construction costs.

Empyrion Digital is developing a 9-floor data center in the heart of the Gangnam Business District and is due to go-live in 3Q 2025. It will offer 30MW of IT load capacity suitable for a range of services, including AI, with an emphasis on strong environmental performance.

-------------------------------------------------------------------------------------------------------------------------

This article was contributed by John Pritchard, head of tenant advisory group, global services at Cushman & Wakefield Korea.

Copyright ⓒ Aju Press All rights reserved.