Editor's Note: This article is the third installment in our series on Asia's top 100 companies, exploring the strategies, challenges, and innovations driving the region's most influential corporations.

SEOUL, January 16 (AJP) - As Samsung Electronics, South Korea’s largest company and a bellwether of the nation’s economy, faces intensifying competition in AI chips and geopolitical uncertainties, it stands at a pivotal moment.

How it responds in the coming years will shape not only its own future, but also the broader trajectory of South Korea’s economy.

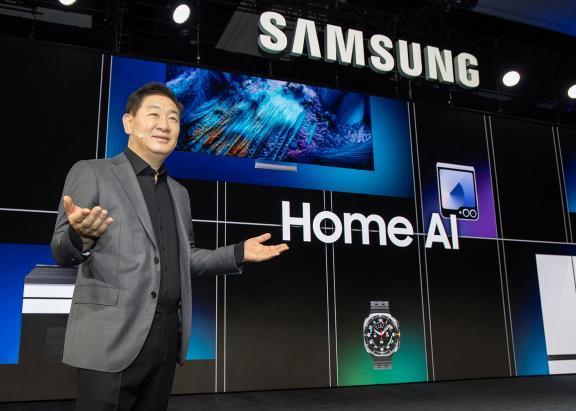

The company recently found itself under an unflattering spotlight at CES 2025 when Nvidia CEO Jensen Huang urged the firm to redesign its high-bandwidth memory (HBM) chips while expressing confidence that it will recover. The moment underscored the mounting challenges facing Samsung as it grapples with tough competition in the AI semiconductor market.

In contrast, domestic rival SK hynix reported 7.03 trillion won in operating profit during the same period, signaling a seismic shift in the competitive landscape.

The company’s struggles are particularly acute in the AI chip market. Samsung holds less than 10 percent of the HBM market share, compared to Nvidia’s commanding 90 percent. Delays in developing its fifth-generation HBM3E memory chips have jeopardized potential deals with Nvidia.

In addition, Samsung’s smartphone division, once a symbol of its global dominance, is under pressure. Aggressive pricing and rapid innovation by Chinese rivals have eroded its market share, while global saturation in the smartphone market and longer replacement cycles have further dampened sales.

Externally, geopolitical tensions and currency fluctuations add to the strain. A stronger Korean won has hurt export competitiveness, while U.S.-China trade tensions complicate Samsung’s supply chains and market access.

Conglomerate beyond electronics

Founded in 1969 with just 36 employees, Samsung Electronics has grown into a global leader in semiconductors, smartphones, and consumer electronics. Its transformation from assembling black-and-white televisions to becoming a technological powerhouse was fueled by early partnerships with Japanese firms like Sanyo and NEC.

These alliances provided a foundation for growth, though later disputes pushed Samsung to develop its own semiconductor technology - a decision that would define its future.

Today, Samsung Electronics operates through two major divisions: Device Experience (DX), which oversees consumer electronics and mobile devices, and Device Solutions (DS), responsible for semiconductors. In 2022, DX generated 182.4 trillion won ($137 billion) in revenue, while DS contributed 98.4 trillion won ($74 billion), reflecting the company’s diverse yet interconnected business portfolio.

The group also plays a pivotal role in sectors like insurance, heavy industries, and biotech, making it a cornerstone of South Korea’s economy.

The company accounts for 20 percent of the country’s gross domestic product and employs 260,000 people directly. It also represents more than 20 percent of the Korean stock market’s value, making its fortunes inseparable from the nation’s economic health.

Lee Jae-yong, who took over as chairman in 2022 following the death of his father, faces the daunting task of steering Samsung through these turbulent times. Lee’s announcement that he would not pass control to his children marks a potential end to the family’s multi-generational leadership, raising questions about the company’s future governance.

Samsung’s ability to navigate these challenges will determine its place in the global tech hierarchy. The company must not only innovate technologically but also adapt its corporate culture and business models to a rapidly changing market.

Copyright ⓒ Aju Press All rights reserved.