*Updated with additional information and market response

SEOUL, December 30 (AJP) - South Korea’s factory output rebounded in November after two consecutive monthly contractions, supported by a sharp pickup in semiconductor production and increased facility investment linked to AI-driven chip demand, government data showed Tuesday.

Mining and manufacturing output rose 0.6 percent from the previous month, reversing declines of 4.2 percent in October and 1.0 percent in September, according to the Ministry of Data and Statistics.

Factory activity heavily reliant on semiconductors

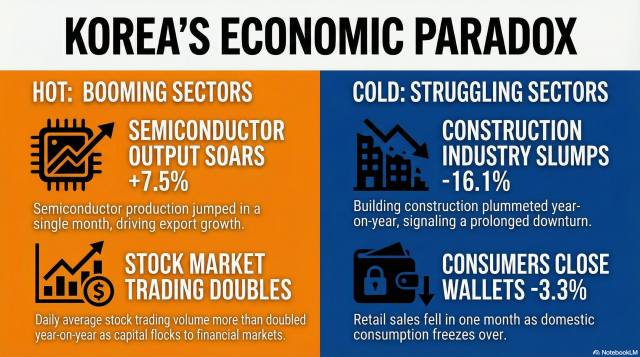

The rebound largely owed to a 7.5 percent jump in semiconductor output and external demand. Output for export shipments climbed 4.6 percent, while production for domestic sales fell 4.5 percent.

The report went largely unnoticed by the Korean markets on their last trading day for 2025. KOSPI was 0.2 percent lower at 4,212.61 as of 11:25 a.m. and the U.S. dollar at 1,434.40 won.

By sector, pharmaceutical exports surged 23.7 percent from the previous month, while semiconductor exports rose 11.7 percent. In contrast, refined petroleum exports declined 4.1 percent as the petrochemical industry remained mired in a prolonged downturn.

Overall industrial production increased 0.9 percent from October, compared with a 2.7 percent drop a month earlier. Service-sector output edged up 0.7 percent, but retail sales slid 3.3 percent, reflecting persistent weakness in private consumption.

Facility investment rose 1.5 percent on month, led by machinery investment. The increase was driven by higher spending on precision equipment, including semiconductor inspection tools, as chipmakers expanded capacity to meet AI-driven demand.

Manufacturing shipments climbed 1.6 percent from the previous month. Semiconductor shipments surged 12.1 percent on month and 9.1 percent on year, while machinery equipment shipments rose 3.5 percent and 2.3 percent, respectively.

Output of “other transport equipment,” dominated by shipbuilding, fell 12.4 percent on month but remained on an upward trajectory year on year, rising 17.3 percent, reflecting the start of full-scale deliveries of LNG carriers ordered under Qatar-related projects.

Manufacturing inventories increased 0.6 percent from the previous month. Semiconductor inventories, however, plunged 42.6 percent from a year earlier, reflecting aggressive stockpiling amid fears of supply shortages driven by AI demand.

By contrast, inventories of electrical equipment such as batteries rose 12.6 percent on month, while output in the sector fell 8 percent on year, signaling accumulation amid the prolonged electric-vehicle slowdown and repeated overseas order cancellations faced by LG Energy Solution. Refined petroleum inventories also climbed 9.9 percent, pointing to continued weakness in the petrochemical industry.

Construction rebound masks deep structural slump

Construction output rose 6.6 percent from the previous month, largely due to a higher number of working days compared with October, which included the Chuseok holiday, as well as year-end project completions.

Building construction increased 9.6 percent on month, while civil engineering output fell 1.1 percent.

On a yearly basis, however, the sector remained deeply depressed. Building construction dropped 16.1 percent from a year earlier, while civil engineering fell 19.7 percent, effectively wiping out nearly one-fifth of last year’s activity. The downturn reflects weak orders throughout 2024, driven by high interest rates and elevated construction costs.

Construction orders continued to shrink, falling 9.2 percent on year. Civil engineering orders, including power plants and communication facilities, plunged 17.3 percent, while building orders declined 7.3 percent, pointing to ongoing disruptions in housing supply.

The weakness also spilled into services. Real estate-related services, centered on brokerage activity, fell 2.4 percent as tighter debt service ratio (DSR) regulations and supply constraints weighed on transactions. This made real estate the only major service category to contract, even as overall service output rose 3 percent on year.

Consumers pull back as financial activity surges

Retail sales reversed course, falling 3.3 percent on month after a temporary October rebound fueled by holiday demand. Sales of non-durable goods such as food declined 4.3 percent amid rising prices, while semi-durable goods like clothing dropped 3.6 percent.

Durable goods sales, including communication devices and computers, also fell 0.6 percent, following a spike in general-purpose semiconductor prices in November.

By retail channel, sales at supermarkets and department stores dropped 4.8 percent and 8.3 percent on year, respectively, underscoring continued pressure on household spending.

In contrast, the financial sector continued to expand on buoyant equity trading. Output in finance and insurance rose 2.2 percent from the previous month and 4.2 percent from a year earlier.

The combined daily average trading value of the KOSPI and KOSDAQ reached 38 trillion won ($26.2 billion) in November, more than double the level a year earlier. Margin trading also exceeded 26 trillion won as of Nov. 28, highlighting a growing polarization in the economy — with capital increasingly concentrated in financial markets while consumption, construction and real estate remain subdued.

Copyright ⓒ Aju Press All rights reserved.