SEOUL, January 20 (AJP) - South Korea’s stock market is extending its red-hot rally into the new year while quietly pushing out near-defunct companies, using favorable market momentum to rationalize both its main and secondary bourses.

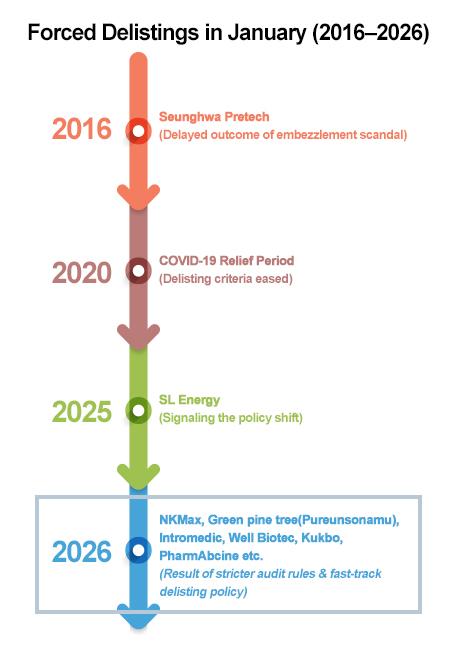

According to data from the Korea Exchange (KRX) as of Tuesday, five companies — Pureunsonamu, Intromedic, Well Biotec, Kukbo and PharmAbcine — are currently undergoing delisting procedures.

Of the five, Well Biotec and Kukbo are listed on the KOSPI, while the remaining three trade on the KOSDAQ. Including NKMAX, which was delisted earlier this month, and AMCG, which entered liquidation on the dormant KONEX board, the total number of exits from the Seoul bourse in January rises to seven.

Such activity is highly unusual for January, traditionally considered a grace period as deadlines for annual audit reports typically fall in March. In the history of South Korea’s securities market, liquidation trading in January has occurred only twice — Seunghwa Pretech in 2016 and SL Energy in 2025. Outside of those exceptions, there have been no recorded cases of January liquidation trading.

The cleanup reflects a broader government-led initiative to remove non-viable firms from the market.

A year ago, the Financial Services Commission (FSC) and the KRX unveiled a sweeping reform plan covering initial public offerings and delisting procedures. The most notable change was a significant streamlining of the delisting review process.

Under the revised framework, authorities eliminated the second stage of the traditional three-tier review system — which previously consisted of a Corporate Review Committee followed by two consecutive Market Committees. As a result, the maximum delisting review period has been cut in half, from four years to two. In addition, companies receiving a “disclaimer of opinion” from auditors for two consecutive years are now subject to immediate delisting without a grace period.

From this year through 2028, listed companies must also meet progressively higher thresholds for market capitalization and revenue to retain their listings. KOSPI-listed firms are required to maintain a minimum market capitalization of 50 billion won ($33.8 million) and annual revenue of 20 billion won, while KOSDAQ-listed firms must meet thresholds of 30 billion won in market capitalization and 7.5 billion won in revenue to avoid delisting review.

The primary driver behind the regulatory overhaul was the rapid deterioration of the tech-heavy KOSDAQ market.

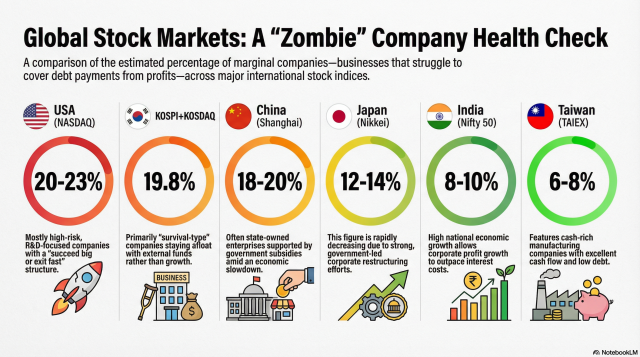

Data from the Bank of Korea and the KRX show that the proportion of so-called “marginal firms” — commonly referred to as zombie companies that fail to generate sufficient operating profit to cover interest expenses — on the KOSDAQ rose nearly 50 percent, from 16.5 percent in 2021 to about 24.5 percent in 2025. While the KOSPI has historically been subject to stricter oversight, the share of marginal firms on the main board also increased from 9.8 percent to an estimated 11.2 percent over the same period.

The combined market average is now approaching the 20 percent threshold, a level exceeded only by U.S. markets. This trend contrasts sharply with regional peers: Japan’s Nikkei 225 maintains a marginal-firm ratio below 15 percent, while Taiwan’s TAIEX remains below 10 percent. The weak quality of listed firms has long been cited as a key driver of the so-called “Korea Discount,” discouraging foreign investor inflows and prompting the government’s more aggressive intervention.

Market experts say tighter listing and delisting standards are likely to support the ongoing rally.

“There is a clear expectation that stricter delisting criteria will restructure the market around healthier companies,” said Na Jeong-hwan, a researcher at NH Securities. “When the government unveiled its KOSDAQ support measures late last year, attention focused on the potential for market normalization through the exit of distressed firms.”

Indeed, the KOSDAQ index rose about 10.3 percent in January last year following the initial announcement of tougher standards. After a renewed pledge on Dec. 19 to accelerate the removal of zombie firms, the index has gained more than 6 percent as of Tuesday’s close, suggesting that prolonged inaction on non-viable companies had been a major drag on investor sentiment.

“Establishing clear guidelines for managing distressed firms could have a positive impact not only on the KOSDAQ but across the entire securities market, including the KOSPI,” Na added.

Still, skepticism remains over whether the latest measures will translate into sustained enforcement.

“The government has repeatedly announced plans to manage and clean up distressed firms, but those statements have rarely resulted in meaningful action,” said Kim Hak-kyun, head of research at Shinyoung Securities.

“We need to watch closely whether this policy produces tangible results," said an official at the KRX, speaking on condition of anonymity.

On Tuesday, the KOSPI closed at 4,885.75 and the KOSDAQ at 976.37. Compared with the same day a year earlier, the KOSPI has nearly doubled, posting a 94 percent gain, while the KOSDAQ has risen more than 34 percent.

Copyright ⓒ Aju Press All rights reserved.