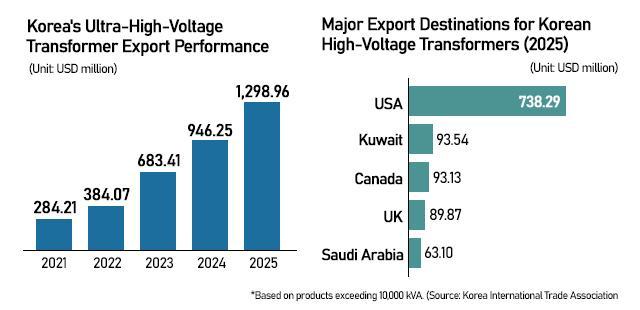

Exports of transformers rated at 10,000 kilovolt-ampere (kVA) or higher reached $1.3 billion last year, according to the Korea International Trade Association. It marked the first time shipments topped the $1 billion mark since 2010 and the highest level since records began in 1977.

The United States accounted for the largest share, importing about $738 million worth of Korean transformers. Shipments to the U.S. jumped nearly sevenfold over the past three years, fueled by the dual need to replace aging grid infrastructure and connect newly built AI data centers to power networks.

"Large-scale AI data centers have extremely high GPU server density, which causes electricity demand to surge," said Lee Sang-heon, an analyst at iM Securities. "High-capacity, high-efficiency transformers are essential, and switchboards that distribute, disconnect and protect the power flowing from these transformers are also key equipment."

According to the International Energy Agency, global electricity demand from data centers is projected to more than double to about 945 terawatt-hours by 2030, roughly equivalent to Japan's current total power consumption. AI-optimized data centers are expected to be the main driver, with their electricity demand forecast to quadruple by the end of the decade.

In the United States, data centers are on track to account for nearly half of total electricity demand growth through 2030. By then, the country is expected to consume more power processing data than manufacturing aluminum, steel, cement and chemicals combined.

This surge in power demand has triggered a global scramble for transformers. Lead times for large power transformers have stretched beyond 200 weeks, and equipment shortages are increasingly cited as a major bottleneck for data center development. Companies such as Amazon have reported project delays due to limited transformer availability.

South Korea's major power-equipment makers — HD Hyundai Electric, Hyosung Heavy Industries and LS Electric — have secured order backlogs stretching five to six years ahead, with some contracts already booked through 2031.

To meet demand, the firms are ramping up production.

HD Hyundai Electric is expanding its transformer plant in Alabama, aiming to boost capacity by 30 percent by early 2026. Hyosung Heavy Industries plans to nearly double annual output at its Memphis facility to more than 250 units by 2027 and recently announced a $225 million investment in a new high-voltage direct current (HVDC) transformer plant in Changwon.

LS Electric said in its third-quarter report that it plans to invest in facilities in Texas and Utah to expand production.

Korean manufacturers currently hold about 25 percent of the U.S. transformer market, benefiting from differentiated technology, competitive pricing and the ability to deliver customized products faster than many rivals.

Exports are also diversifying beyond the U.S. Shipments to the United Kingdom rose to 126 billion won through November last year, up from 50 billion won in 2023, as Britain accelerates grid modernization. HD Hyundai Electric secured a 220 billion won contract from UK National Grid, while Hyosung Heavy Industries signed a 120 billion won deal with Scottish Power Energy Networks.

Korean power-equipment firms are also developing next-generation grid-stabilization technologies. Hyosung Heavy Industries said Tuesday it partnered with Germany's Skeleton Technologies and Japan's Marubeni to develop e-STATCOM, a power compensation system designed to maintain grid stability amid fluctuating demand from AI-driven industries and renewable energy sources.

Industry analysts expect the boom to continue. The North American transformer market is projected to grow to $41.62 billion by 2030, up from $30.28 billion last year, according to Markets and Markets, driven by infrastructure replacement and AI-related power demand.

The surge in demand has been mirrored in the stock market. HD Hyundai Electric traded at 897,000 won on Wednesday, up 132.99 percent from a year earlier, while LS Electric rose 144.44 percent to 504,000 won.

Hyosung Heavy Industries posted the biggest gain among the three, soaring 398.5 percent to 2,324,000 won.

Copyright ⓒ Aju Press All rights reserved.

![[South Korea-Japan Ties] Korea, Japan explore power link as AI drives electricity demand](https://image.ajunews.com/content/image/2025/09/30/20250930060605912601_278_163.jpg)