The lender has set its offering price at 8,300 won ($5.75), the bottom of its indicative range of 8,300 to 9,500 won, following institutional bookbuilding earlier this month. Kbank will begin trading on March 5 in its third attempt to go public, after withdrawing previous listings in 2022 and 2024 over valuation concerns.

Institutional demand forecasting was conducted from Feb. 4 to 10, drawing participation from 2,007 investors and posting a competition ratio of 198.5 to 1. Total orders reached about 58 trillion won. Despite the strong headline demand, many institutions reportedly bid at or below the lower end of the range.

Based on the final price, the total offering size stands at about 498 billion won, with post-listing market capitalization estimated at roughly 3.37 trillion won.

At the offer price, Kbank is valued at around 1.38 times price-to-book (PBR), positioning it at a discount to both its online peer and major traditional lenders.

Rival KakaoBank closed last trading session on Friday at 27,400 won, trading at a PBR of 1.94. Meanwhile, banking sector heavyweight KB Financial Group ended at 167,900 won with a PBR of 1.02.

The valuation gap suggests potential room for rerating if Kbank narrows the spread with KakaoBank by demonstrating sustained earnings growth and improved business diversification.

“Kbank’s pricing is not excessive in a rising banking sector,” said a Seoul-based IPO analyst. “But the market is still demanding a risk premium.”

Overhang and Lock-up Concerns

A key investor downside is the scale of potential selling pressure after listing.

About 35.34 percent of outstanding shares, worth roughly 1.1 trillion won at the offer price, will be freely tradable on debut. Nearly half of the offering consists of shares sold by existing investors, reflecting strong exit demand.

In addition, only 12.4 percent of participating institutions agreed to lock-up periods, raising the likelihood of near-term supply pressure.

Kbank’s earnings structure is another focal point for investors.

As of end-2025, about 30 percent of its fee income was generated through partnerships linked to Upbit, South Korea’s largest digital asset platform.

The partnership agreement is set to expire in October 2026, making renewal negotiations a major earnings variable.

Founded in 2016, Kbank had 15.53 million customers as of end-2025. It posted net profit of 128.1 billion won in 2024 and 103.4 billion won in the first three quarters of 2025.

Management expects the IPO to strengthen capital buffers and expand lending capacity. Once listed, about 725 billion won from past capital injections will be newly recognized in equity calculations, translating into close to 1 trillion won in effective capital expansion.

This is expected to support more than 10 trillion won in additional loan capacity.

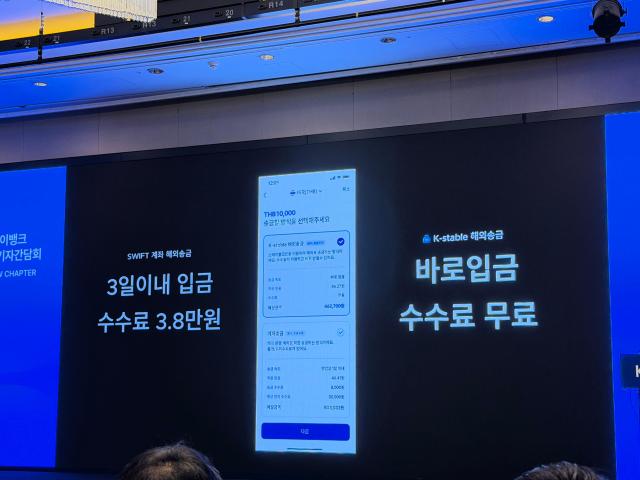

Growth priorities include loans to self-employed workers and small and medium-sized enterprises, expansion of Banking-as-a-Service (BaaS) partnerships, and development of digital asset-related services, including stablecoin-linked payment and remittance infrastructure.

“We appreciate investors who share our long-term vision,” said Chief Executive Officer Choi Woo-hyung. “After listing, we will continue to grow alongside customers and shareholders while delivering differentiated value.”

Retail subscriptions will be conducted on Feb. 20 and 23 for up to 30 percent of the total offering, or about 18 million shares.

Investors can participate through lead managers NH Investment & Securities and Samsung Securities, as well as co-underwriter Shinhan Securities.

Copyright ⓒ Aju Press All rights reserved.