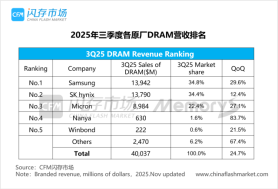

SEOUL, December 17 (AJP) - Soaring memory prices — spilling over from DRAM into NAND flash that powers smartphones — are forcing device makers to respond with specification downgrades or price hikes. Samsung Electronics, however, with its full-cycle smartphone capabilities spanning memory, application processors, displays and handsets, may hold the strongest edge, particularly in the premium segment.

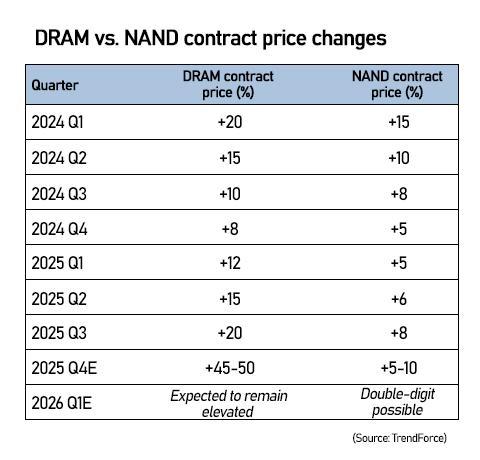

Memory prices are projected to climb sharply again in the first quarter of 2026, pressuring smartphone and notebook brands to either raise prices or cut specifications, according to market tracker TrendForce. As memory accounts for a growing share of device bills of materials, the upcycle is already translating into concrete changes in pricing strategies and product configurations across the industry.

What was once a theoretical cost risk is becoming a market reality. Manufacturers are adjusting launch prices, trimming memory options or shortening product lifecycles to cope with rising component costs. The question is whether any player can respond differently — and whether Samsung’s in-house NAND supply gives it that flexibility.

TrendForce estimates that memory components, including DRAM and NAND flash, will take up a significantly larger share of smartphone BOM costs in early 2026 as prices remain elevated. Even Apple, known for its pricing power, is expected to reassess pricing strategies for new models and scale back discounts on older ones as memory costs rise, the firm said.

Memory is among the most cost-sensitive components in a flagship smartphone. Teardown analyses by Counterpoint Research and TechInsights show that DRAM and NAND together account for roughly 18 to 23 percent of a premium device’s BOM, placing memory alongside application processors and displays as one of the largest cost categories.

Within that slice, NAND plays an outsized role. Storage typically represents more than half of total memory costs, and its impact escalates rapidly as manufacturers push higher-capacity models. Moving from 128GB to 512GB can multiply NAND costs three- to four-fold, making storage configuration a critical lever for margins and pricing.

This is where Samsung’s structure stands apart. Unlike most smartphone makers, Samsung sources the majority of its NAND internally, with its semiconductor-focused Device Solutions division supplying advanced UFS storage directly to its Mobile eXperience business. That vertical integration allows Samsung to adjust internal transfer pricing, potentially cushioning its smartphone unit from the full force of market-level NAND price increases.

“The advantage lies primarily in supply stability,” said Yangpaeng Kim, a researcher at the Korea Institute for Industrial Economics and Trade.

“Because Samsung produces its own NAND, it can stabilize its supply chain through internal transactions,” Kim said. “Even at the same price level, securing components internally provides a meaningful advantage. Supply stability alone can be a significant edge.”

Apple, by contrast, relies entirely on external suppliers for NAND, including Samsung Electronics, Kioxia and SK hynix. While long-term contracts and large-scale procurement help smooth volatility, Apple remains directly exposed to higher contract prices when NAND costs rise, analysts say. This has reinforced Apple’s reliance on storage tiering — keeping base models at lower capacities while charging steep premiums for upgrades.

TrendForce noted that cutting specifications or delaying upgrades has become an essential cost-control tool for device makers. Among Android brands targeting the mid- to low-end segments, where memory capacity is a key selling point, rising costs are already prompting price increases and revisions to existing product lineups.

The broader cost environment is adding to the strain. A weak won is pushing up the price of imported components, while costs for high-end application processors and advanced OLED displays continue to rise. Industry sources say the pace of cost inflation is too rapid for device makers to absorb indefinitely.

Whether Samsung’s structural advantage translates into sustained pricing power remains an open question. Internal sourcing can soften the initial shock, but it does not eliminate cost pressure — it redistributes it within the group. The coming pricing cycle will test whether Samsung can preserve storage specifications or price points longer than rivals, or whether it, too, will be forced into the same trade-offs now spreading across the industry.

Some in the industry speculate that Samsung is carefully controlling the rollout of the world’s first trifold smartphones following initial bookings in December, reflecting the high production costs involved.

Copyright ⓒ Aju Press All rights reserved.