SEOUL, December 22 (AJP) -More than half of South Korea's big companies predict a tough year ahead, citing challenging foreign-exchange conditions and sluggish domestic demand weighed down by inflationary pressure.

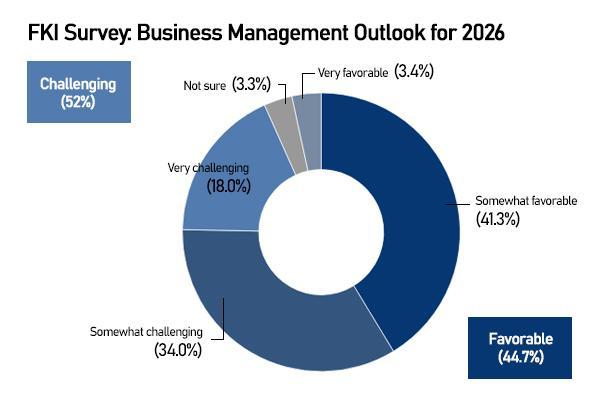

According to a survey on corporate management conditions for 2026 by the Federation of Korean Industries (FKI), 52 percent of respondents forecast difficult management conditions next year, including 18 percent who expect the environment to be “very challenging.” Only 3.4 percent anticipate a very favorable year.

The business lobby surveyed the country’s 1,000 largest companies by sales, with responses collected from 150 firms.

A weak industry outlook was cited as the most significant headwind, followed by a prolonged economic slowdown and persistent global uncertainty.

On the domestic front, delayed recovery in demand topped corporate concerns at 32.2 percent, followed by sticky inflation at 21.6 percent and uncertainty over interest-rate policy at 13.1 percent.

Externally, firms pointed to heightened foreign-exchange volatility, including exchange-rate fluctuations, as the leading risk at 26.7 percent. Rising trade barriers accounted for 24.9 percent, while concerns over a global economic slowdown (19.8 percent) and uncertainty surrounding energy and raw-material imports (15.3 percent) also featured prominently — underscoring how inflationary pressures linked to a weak won are emerging as a key challenge for Korean companies.

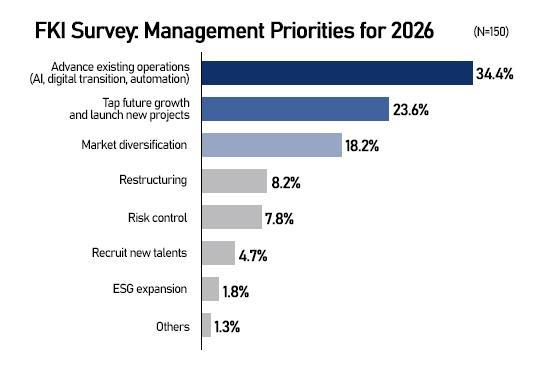

Reflecting a more defensive posture, companies signaled restraint in capital spending. Rather than pursuing new growth engines, 34 percent said they would prioritize upgrades to existing operations, while 23.6 percent planned investment aimed at future growth. Another 8.2 percent indicated a focus on cost-cutting and business rationalization.

Copyright ⓒ Aju Press All rights reserved.