Editor's Note: This is the fifth installment in AJP's 2026 outlook series on South Korea's key industries.

SEOUL, December 24 (AJP) - By the numbers, K-fashion is barely moving. Beneath the surface, however, control of the industry is shifting rapidly from department-store legacy brands to platform-born labels that now define how younger Koreans dress.

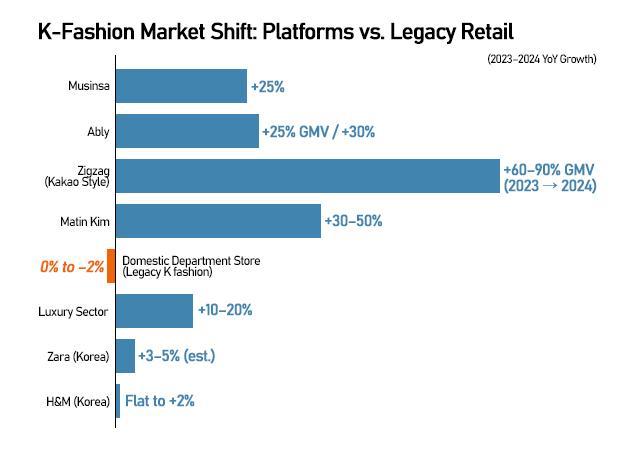

Korea’s overall fashion market grew only about 2–3 percent in 2024 and is estimated to have expanded at a similar pace in 2025, according to the Samsung Fashion Institute. Yet that headline stagnation masks a sharp redistribution of growth toward online platforms and the brands they incubate.

The Korea Chamber of Commerce and Industry projects industry output will rebound to 52.2 trillion won in 2026, reversing an estimated 2.5 percent decline to 51.8 trillion won this year. Exports are expected to rise 2 percent to $9.96 billion next year after a 6.7 percent fall in 2025 — a recovery driven largely by platform-led expansion.

At the center of that shift is Musinsa, which recorded gross merchandise volume of about 4.5 trillion won in 2024. Revenue surpassed 1.24 trillion won for the first time, and operating profit topped 100 billion won. Rival platforms are scaling quickly: Ably reached roughly 2.5 trillion won in GMV last year, while Zigzag nearly doubled transaction volume year on year and exceeded its full-year 2023 GMV in the first half of 2025 alone.

Much of that growth is coming from brands born on — or propelled by — these platforms. Musinsa’s private label Musinsa Standard has become one of Korea’s best-selling basics brands, while labels such as thisisneverthat, LMC and Matin Kim now anchor online rankings and offline pop-ups alike.

Matin Kim’s trajectory captures the shift. Launched online, the brand has expanded into department stores, select shops and overseas markets, targeting annual sales of around 200 billion won in 2025 as it pushes into Japan, China and the United States.

Department stores, by contrast, are increasingly split. Imported luxury houses and global sportswear brands continue to post double-digit growth, but long-established Korean suit and casual labels remain stuck in stagnation or decline.

“Department-store brands no longer feel distinctive,” said Lee Eun-hee, emeritus professor of consumer studies at Inha University. “The quality gap that once justified them has largely disappeared. Younger consumers now seek brands that express individuality rather than standardized offerings.”

Social media has accelerated that shift. Korea’s 20s and 30s, raised in an SNS-saturated environment, increasingly avoid looking ordinary — pushing them toward platform-based labels that signal visible differentiation.

Survey data show younger shoppers now treat platforms such as Musinsa, Ably and Zigzag as their default destination for everyday clothing, using department stores mainly for luxury or special occasions. Domestic department-store brands are often associated with parents’ or office seniors’ wardrobes, while global SPA chains like Zara and H&M are viewed as complements rather than trendsetters.

Zigzag’s internal data also reflect the platform-driven shift. Searches for key fashion categories such as puff cardigans (+202 percent), one-piece dresses (+524 percent) and flare pants (+105 percent) surged this year.

“While Zigzag serves a wide age range, the surge in activity among users in their 20s and 30s has been especially noticeable this year,” a Zigzag representative said.

Legacy brands face mounting pressure. Analysts say rigid seasonal cycles, heavy wholesale structures and conservative design languages make it difficult to compete with platforms that can test dozens of micro-trends weekly and scale winners almost instantly.

With the overall market growing only in the low single digits — and fashion imports estimated at $19.17 billion this year and $19.44 billion next year — the implication is clear. Every point of growth captured by platform-born brands is coming at someone else’s expense.

For now, that cost is being borne by the legacy domestic labels that once defined the department-store floor.

Copyright ⓒ Aju Press All rights reserved.