SEOUL, January 9 (AJP) - LG Energy Solution, having endured multiple headwinds including a labor raid at its U.S. plant and the cancellation of major battery supply contracts, swung to an operating loss in the fourth quarter, even as full-year profit more than doubled on strong data-center-driven demand for energy storage systems.

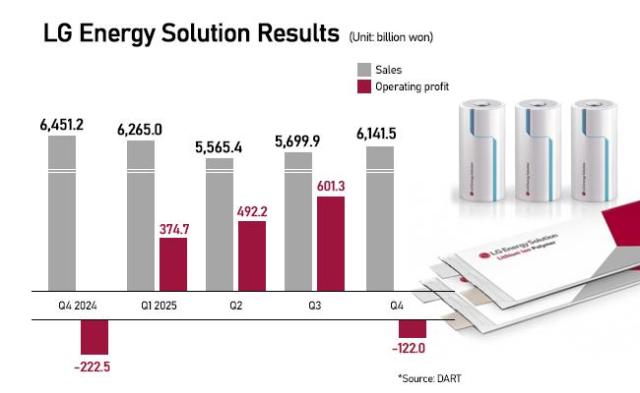

In preliminary earnings released Friday, the South Korean battery maker reported full-year operating profit of 1.35 trillion won ($1.0 billion) for 2025, more than doubling from 575.4 billion won in 2024. Full-year revenue came to 23.67 trillion won, down 7.6 percent from a year earlier.

For the October–December quarter, the company posted an operating loss of 122.0 billion won, compared with a loss of 225.5 billion won a year earlier, while quarterly revenue slipped 4.8 percent year on year to 6.14 trillion won.

Excluding tax credits under the Inflation Reduction Act, the fourth-quarter operating loss widened to 454.8 billion won, translating into a negative margin of 7.4 percent.

The figures are preliminary and may change following audits of overseas subsidiaries and affiliates. LG Energy Solution said it will release final results, including net profit and a detailed breakdown by business division, later this month.

The poor quarterly results follow a string of setbacks in the company’s electric-vehicle battery business. LG Energy Solution last month terminated a 3.9 trillion won ($2.7 billion) battery supply contract with Freudenberg Battery Power Systems, marking the second major cancellation after it ended a 9.6 trillion won battery supply contract with Ford Motor Co.

The two cancellations bring the total value of terminated contracts in December to 13.5 trillion won—equivalent to more than half of the company’s annual revenue of 25.6 trillion won recorded in 2024.

The company also suffered a disruption at its battery plant construction site in Georgia in September, when U.S. authorities conducted a large-scale labor raid that led to the arrest of 475 workers and a temporary halt to construction.

Shares ended Friday 0.8 percent down at 363,000 won.

Copyright ⓒ Aju Press All rights reserved.