SEOUL, January 09 (AJP) - The memory cycle shaping today’s intelligence-driven computing is being defined less by consumer gadgets than by infrastructure — a shift underscored by the latest performance of industry leader Samsung Electronics.

The South Korean tech giant reported operating profit of 20.0 trillion won ($14 billion) for the October–December quarter, more than tripling from a year earlier and marking its strongest three-month result on record. Revenue rose 22.7 percent to 93.0 trillion won, according to preliminary earnings released Thursday.

While the numbers recall the last memory supercycle in 2018, the forces behind the current upswing are fundamentally different.

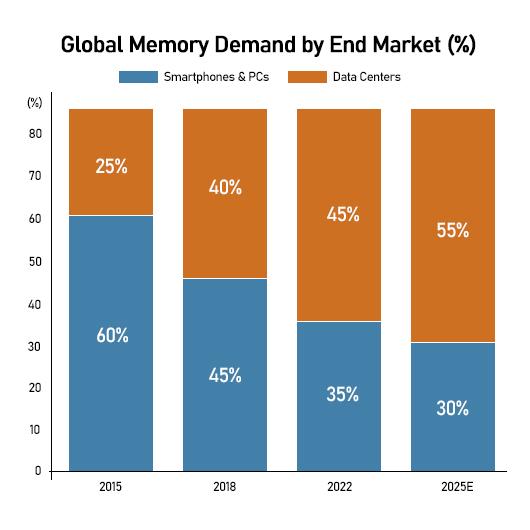

The center of gravity in memory demand had already shifted from smartphones and PCs to data centers in the late 2010s. Artificial intelligence has now accelerated that transition — not only in scale, but in intensity.

“The industry’s growth engine moved from smartphones and PCs to data centers after 2017,” said Ahn Ki-hyun, secretary general of the Korea Semiconductor Industry Association. “What is different now is that AI is no longer just a corporate tool. As individuals increasingly use AI services, demand for GPUs and memory is expanding on an entirely new scale.”

From cloud cycle to AI-driven expansion

According to TrendForce and Counterpoint Research, average selling prices for DRAM jumped 45–50 percent in the fourth quarter, while NAND prices rose more than 30 percent, as chipmakers shifted capacity toward high-margin AI memory such as high-bandwidth memory (HBM) and DDR5.

At Samsung, the device solutions (DS) division is estimated to have generated about 16–17 trillion won in operating profit during the quarter, with HBM shipments to AI server customers emerging as the primary growth engine.

The demand shift is also visible in how memory consumption is structured. Data from World Semiconductor Trade Statistics (WSTS) show that data centers now account for more than half of global memory demand, up sharply from roughly a quarter during the previous supercycle — effectively turning cloud service providers into the industry’s largest customers.

HBM, once a niche product used mainly in graphics and specialized computing, has become a central profit driver. TrendForce estimates that HBM’s share of total DRAM revenue has climbed from less than 5 percent in 2022 to more than 30 percent in 2025, even though its shipment volume remains far smaller than conventional memory — a reflection of its premium pricing and strategic importance in AI servers.

Ripple effects across the memory market

The pivot toward AI memory is reshaping the broader market as well. As manufacturers prioritize HBM and DDR5, output of legacy products such as DDR4 has tightened sharply, triggering a rare price surge of more than 30 percent for DDR4 in late 2025 — an unusual development in a segment long regarded as commoditized.

“The rise of AI is changing the structure of the memory industry,” Ahn said. “Today, it is not just enterprises but individuals using AI services that are driving demand for GPUs, and that directly translates into higher demand for advanced memory.”

Behind the surge is an unprecedented wave of capital spending by global technology firms. Amazon, Microsoft, Alphabet and Meta together are expected to invest well over $300 billion this year in data centers, custom chips and AI infrastructure, cementing cloud providers — and increasingly AI service platforms — as the new center of gravity in the semiconductor cycle.

Industry researchers estimate that AI server shipments are growing at a compound annual rate of more than 20 percent, while power consumption at data centers is projected to rise nearly 175 percent by 2030 from 2023 levels — a signal that memory demand is likely to remain structurally elevated.

A longer cycle for memory makers

For Samsung, the shift reinforces a broader strategic realignment. The company is repositioning its memory business away from the short swings of consumer-electronics cycles and toward a role as a core enabler of AI infrastructure, betting that the combination of HBM, advanced packaging and foundry capabilities will anchor earnings even as traditional device markets remain volatile.

As the memory industry moves deeper into the AI era, analysts increasingly view the current upcycle not as a short-lived rebound but as the beginning of a longer structural phase — one in which data centers and AI workloads, not smartphones, set the pace of global semiconductor demand.

Copyright ⓒ Aju Press All rights reserved.