SEOUL, Jan 23 (AJP) - East Asia emerged as the standout winner in global trade last year, with the region’s major exporters all setting new records as demand surged for artificial intelligence–related hardware.

South Korea posted a record $709.5 billion in exports in 2025, up 3.8 percent from the previous year and overtaking Japan’s $696 billion in data released Thursday by Japan’s Ministry of Finance. It marked the first time South Korea surpassed Japan in total export volume.

Taiwan followed closely with $640.7 billion. China earlier reported a record $3.77 trillion in exports.

Beneath the headline figures, however, South Korea’s performance warrants a more sober assessment.

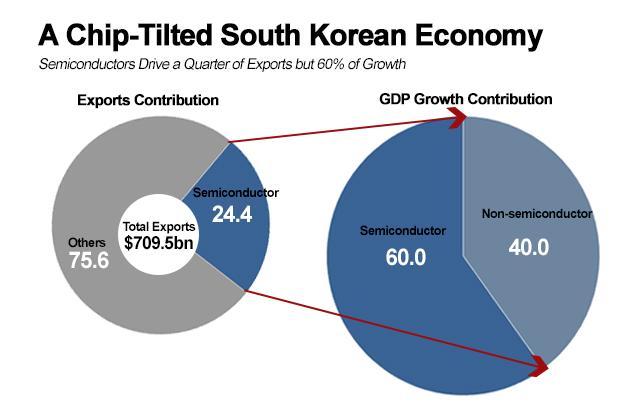

In Korea’s case, semiconductors accounted for roughly one-quarter of total exports, or $173.4 billion, underscoring the economy’s growing dependence on a single sector.

That dominance becomes even more pronounced when viewed through the lens of economic growth.

According to the Bank of Korea’s 2025 GDP data released Thursday, the semiconductor sector contributed 0.6 percentage points to last year’s annualized growth rate of 1 percent—more than half of the total expansion. Excluding chips, the economy would have grown by just 0.4 percent.

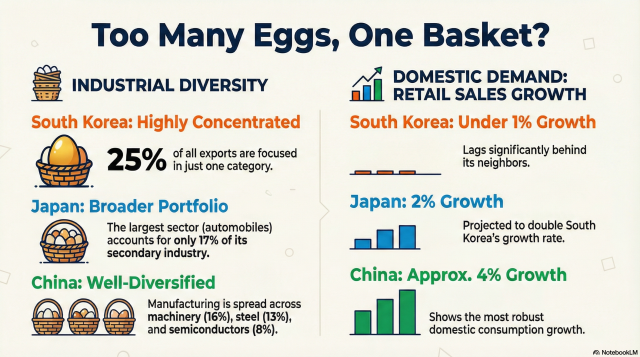

This concentration highlights what economists increasingly describe as South Korea’s “K-shaped” growth structure, particularly when contrasted with China and Japan, both of which retain broader industrial and domestic demand bases.

China’s National Bureau of Statistics reported Monday that its 2025 manufacturing GDP was widely diversified, with machinery and equipment accounting for 16 percent, steel 13 percent, and semiconductors a comparatively modest 8 percent.

Japan, while not a direct competitor in memory chips, also maintains a broad industrial mix. Automobiles—the largest segment of Japan’s secondary industry—account for 17 percent of output, far below Korea’s concentration, where 25 percent of exports are tied to a single category.

Domestic demand further exposes the gap. South Korea’s retail sales growth has remained below 1 percent, while Japan’s is projected to reach around 2 percent, and China’s approximately 4 percent.

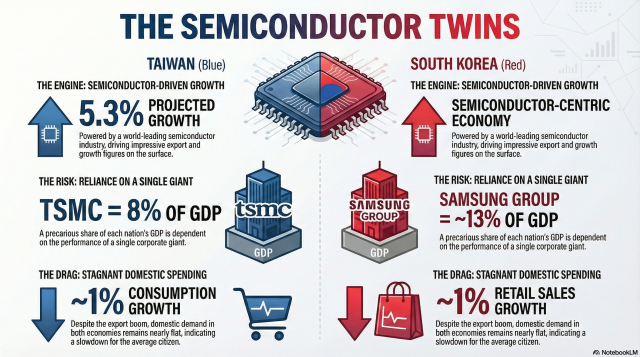

Korea and Taiwan: twin chip engines, shared vulnerabilities

South Korea’s closest economic parallel is Taiwan, which has built a similarly semiconductor-centric growth model. Despite differences in scale, the two economies share striking structural weaknesses.

Taiwan recorded 5.3 percent export growth last year, but that expansion was driven overwhelmingly by advanced chipmaking.

According to research from the Economic and Social Research Council (ESRC), TSMC alone accounts for about 8 percent of Taiwan’s GDP. This mirrors South Korea’s dependence on corporate heavyweights, where Samsung Electronics contributes roughly 5 percent of GDP, and the broader Samsung Group nearly 13 percent.

In both economies, high-end semiconductor manufacturing has generated limited spillover effects into consumption and services. The imbalance is reflected in persistently weak domestic demand.

Taiwan’s Directorate-General of Budget, Accounting and Statistics (DGBAS) reported private consumption growth of around 1 percent as of August 2025. South Korea’s retail sales growth is estimated at a similar level for the year.

Copyright ⓒ Aju Press All rights reserved.