*Updated with additional information and market response

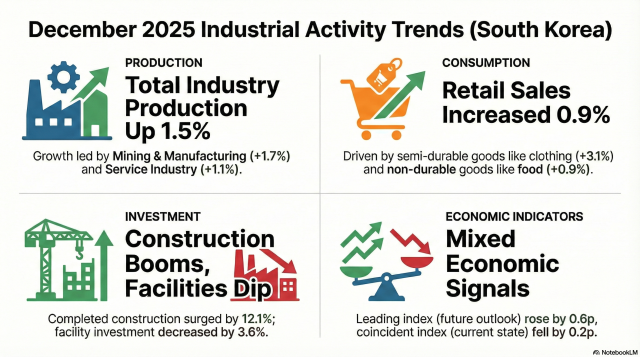

SEOUL, January 30 (AJP) - South Korea’s factory output grew at its fastest pace in four months in December, driven by chip-led exports and a sharp rebound in construction, though growth slowed for full-year 2025 amid prolonged weakness in building activity.

Mining and manufacturing production rose 1.7 percent from the previous month, rebounding from two consecutive contractions and accelerating from a 0.8 percent gain in November, according to data released Friday by the Ministry of Data and Statistics.

Services output increased 1.1 percent on month, with retail sales rising 0.9 percent. Capital investment fell 3.6 percent, while construction investment surged 12.1 percent.

Gains in manufacturing were primarily driven by semiconductors, where production rose 2.9 percent on month, marking a second straight month of expansion. The pace moderated from November’s 8.8 percent surge as the base effect from October’s slump began to fade.

The most significant sector-specific rebound occurred in pharmaceuticals. After a 10.5 percent decline in November, output jumped 10.2 percent in December. Conversely, automobile production — a major pillar of the manufacturing base — fell 2.8 percent, marking its second consecutive monthly decrease.

On a year-on-year basis, production of “other transport equipment,” including ships, surged 26.4 percent, driven by strong orders for specialized vessels such as LNG carriers. However, facility investment in this segment plunged 16.1 percent from the previous month, contributing to an overall 3.6 percent decline in total capital expenditure.

Overall manufacturing shipments rose 2.5 percent. While shipments of automobiles and pharmaceuticals declined, semiconductors and electrical equipment anchored the aggregate gain. Both domestic and export demand showed strength, with domestic shipments rising 1.2 percent and export shipments climbing 4.0 percent.

Korean markets were mixed. The KOSPI was trading at 5,273, up 1.0 percent, while the KOSDAQ remained virtually flat at 1,165. The dollar added 3.8 won to 1,438.8 won.

Domestic front improves

The retail sales index edged up 0.5 percent year on year, driven by a 4.5 percent increase in durable goods, particularly passenger cars.

Still, sticky inflation weighed on spending. Semi-durable goods, such as clothing, fell 2.2 percent, while non-durable goods, including cosmetics, decreased 0.3 percent.

Retail patterns also showed a stark divergence. Year-on-year sales at supermarkets and general stores fell 4.3 percent, department stores dropped 4.4 percent, and convenience stores declined 2.6 percent. In contrast, the retail index for passenger cars and fuel stations rose 5.3 percent. This suggests that while households are tightening their belts on food and daily necessities, spending on automotive-related items has remained elevated.

A standout figure in the latest report was the performance of the construction sector. Construction output surged 12.1 percent from the previous month, reversing a downturn that had persisted for 19 months. The recovery was led by a 13.7 percent increase in building construction and a 7.4 percent rise in civil engineering.

Construction orders also climbed 18.7 percent on month. Building orders, particularly in the residential segment, rose 21.2 percent, while civil engineering orders increased 13.0 percent.

The surge in orders, however, was heavily concentrated in the public sector, which recorded a 65.2 percent jump in contracts. In contrast, private-sector orders — a key gauge of organic market demand — fell 1.3 percent. Analysts say that while output figures point to a short-term rebound, the divergence between public and private orders suggests the sector has yet to achieve a structural recovery.

Five-year streak continues, but momentum falters

For the full year of 2025, South Korea’s total industrial production edged up 0.5 percent, supported by synchronized gains in manufacturing and services. This marked the fifth consecutive year of expansion since 2021.

Mining and manufacturing output rose 1.6 percent for the year, with semiconductors again leading the gains and other transport equipment providing a notable tailwind. Momentum, however, weakened toward year-end, with fourth-quarter production falling 3.2 percent from the previous quarter, signaling a cooling trend in late 2025.

The service sector grew 1.9 percent for the year, supported by increased activity in health and social welfare as well as wholesale and retail trade. By contrast, the education sector contracted, weighing on overall service-sector growth.

Despite the continued expansion, the pace of growth has slowed markedly. After surging 5.5 percent in 2021 on post-pandemic base effects, growth decelerated to 4.8 percent in 2022, 1.2 percent in 2023 and 1.5 percent in 2024. Last year’s 0.5 percent gain marked the first time since the recovery began that growth slipped below the 1 percent threshold.

Copyright ⓒ Aju Press All rights reserved.