SEOUL, February 02 (AJP) - ASML’s ambitious revenue target signals greater room for scaling and production ramp-ups among chipmakers including Samsung Electronics and SK hynix, which together supply roughly 80 percent of the memory used in AI accelerators and hyperscale data centers.

The outlook follows stronger-than-expected 2025 earnings from ASML, which reported total net sales of €32.7 billion ($38.8 billion), while fourth-quarter net bookings surged to €13.16 billion ($15.6 billion), more than double market expectations.

The increase was driven largely by demand for extreme ultraviolet (EUV) lithography systems, which are essential for manufacturing advanced chips used in artificial intelligence workloads. EUV tools accounted for about 56 percent of new bookings in the fourth quarter.

ASML holds a de facto monopoly on EUV lithography, making its production capacity a structural constraint for the global semiconductor industry.

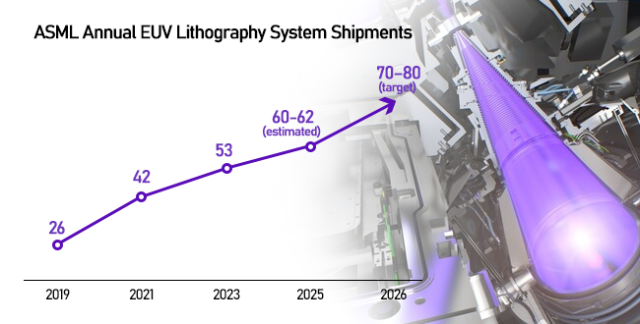

Unlike conventional chipmaking equipment, EUV systems remain a tightly rationed resource due to their complexity and precision requirements. Annual EUV shipments have risen only gradually, from 26 units in 2019 to 42 units in 2021, 53 units in 2023 and an estimated 60–62 units in 2025. For 2026, ASML is targeting output of 70–80 units, its highest level to date, according to industry estimates.

Even at that level, supply remains well below demand. Global chipmakers — including Taiwan Semiconductor Manufacturing Co., Micron Technology and Intel — are competing aggressively for limited allocations, as capacity upgrades and technology transitions increasingly hinge on securing additional EUV machines.

“Lithography tools are the most critical equipment in semiconductor manufacturing, regardless of whether the chips are for memory or logic,” said Lee Jong-hwan, a professor of system semiconductor engineering at Sangmyung University. “Because EUV systems are ultra-precision machines, only a limited number can be produced each year, which is why ASML’s annual output is measured in just several dozen units.”

“In AI semiconductors, both memory and non-memory chips are essential,” he added. “The surge in EUV demand reflects how AI workloads are expanding across both segments. Given that advanced DRAM, including high-bandwidth memory, is now produced at around the 10-nanometer class in Korea, it is highly likely that Samsung Electronics and SK hynix have already secured reservations for sub-10nm EUV tools.”

ASML’s decision to raise its 2026 revenue guidance to €34 billion–€39 billion is therefore widely interpreted as a sign that a substantial portion of next year’s EUV output has already been committed to leading customers, including Korean memory makers ramping up production of high-bandwidth memory and advanced DRAM for AI accelerators.

The company has also doubled its long-term revenue target for 2030 to €60 billion ($71 billion), supported by the successful delivery of its first commercial-grade high–numerical aperture (High-NA) EUV system, the TWINSCAN EXE:5200B.

Compared with standard EUV tools using a 0.33 numerical aperture, the High-NA system operates at 0.55NA, enabling nearly three times the transistor density — a critical advantage for next-generation AI processors. The first systems were delivered to SK hynix and Intel.

With EUV tools costing well over $150 million each and available in limited numbers, competitiveness is increasingly determined not only by access, but by how efficiently chipmakers convert those investments into higher yields and faster production ramps.

SK hynix, the world’s leading supplier of high-bandwidth memory for AI data centers, has already moved early. The company said it installed a production-ready High-NA EUV system at its M16 fab in Icheon in 2025.

ASML also expects its exposure to China to decline as export controls tighten, with China’s revenue share projected to fall from about 33 percent in 2025 to around 20 percent in 2026. Rising demand from South Korea, Taiwan and the United States is expected to more than offset the decline.

As global investment in AI infrastructure accelerates, ASML’s constrained EUV output is set to remain a key gatekeeper — turning access, execution and yield management into decisive variables for Korea’s memory chipmakers in the next phase of the semiconductor cycle.

Copyright ⓒ Aju Press All rights reserved.