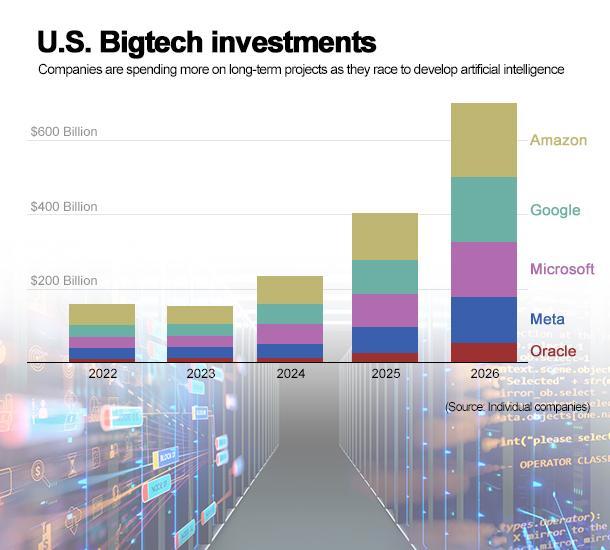

Even so, Seoul's commitment is a small splash in a rapidly deepening global pool.

Big Tech alone is poised to pour roughly $650 billion into AI-related capital expenditure in 2026. Amazon, Alphabet, Meta and Microsoft plan between $635 billion and $665 billion in spending on data centers and AI chips this year — about 67 percent more than their combined outlay in 2025.

In a November report, JPMorgan Chase warned that the industry would need to generate roughly $650 billion in annual revenue through 2030 to secure a 10 percent return on projected investment.

"It's about locking in users early," said Park Han-woo, a professor at Yeungnam University. "Companies are investing aggressively despite limited short-term returns."

President Lee Jae Myung has made AI the centerpiece of his economic agenda, calling the 2026 budget "Korea's first AI-era budget."

Of the 10.1 trillion won allocated — up from 3.3 trillion won in 2025 — about 7.5 trillion won will go toward infrastructure and talent development, including the addition of 15,000 GPUs to bring the government's total to 35,000. Another 2.6 trillion won will fund AI adoption across industries and public services.

"In the AI age, being a day late means falling a generation behind," Lee told parliament.

The "Sovereign AI Foundation Model" Push

At the core of Seoul's strategy is the government-backed "sovereign AI foundation model" competition, aimed at developing homegrown large language models that can rival ChatGPT and Gemini.

The Ministry of Science and ICT selected five consortia in August 2025 — led by LG AI Research, SK Telecom, Naver Cloud, NC AI and Upstage — each receiving substantial computing resources and official "K-AI" developer status.

LG AI Research, SK Telecom and Upstage advanced, with LG ranking first across all criteria. The government plans to narrow the field to two finalists by the end of 2026. Previously eliminated companies, including Kakao and KT, will be eligible to re-enter, though none have signaled interest.

Korea's private sector is also ramping up.

Naver and Kakao roughly doubled facility investment in the third quarter of 2025 year-on-year. Naver's capital expenditure on data centers and servers climbed to 389.5 billion won, with server spending alone jumping from 146.5 billion won to 350 billion won. The company has pledged over 1 trillion won in GPU investments in 2026.

Kakao, which partnered with OpenAI to develop AI agents for its messaging platform, is investing 600 billion won through 2029 to build a dedicated AI data center in Namyangju, while trimming affiliates to redirect capital toward AI.

SK Telecom appears to be making the boldest bet. The carrier reported a 73 percent drop in net income for fiscal 2025 as it funneled capital into AI data centers, yet its shares traded near a 52-week high following its Feb. 5 earnings release.

The company is building a 1-gigawatt AI data center in Ulsan with Amazon Web Services and plans to expand across Southeast Asia, starting with Vietnam.

"SK Telecom is positioned for profit recovery in 2026," said Kim Hong-sik, analyst at Hana Securities, citing a low base and potential inflows if selected as a national AI project operator.

Still, the biggest question looms: profitability.

Experts say the cost burden may ease only when the industry shifts from GPUs — essential for training and running large models — to less power-hungry NPUs capable of deploying lighter models at lower cost.

"GPUs, especially Nvidia's, are advancing faster than the models themselves," said Kong Duk-jo, professor of AI policy and strategy at the Gwangju Institute of Science and Technology. "If fabless NPU firms can build competitive chips, it could open new markets across hardware and software."

He added that on-device AI, already demonstrated by Samsung, shows potential for broad commercial applications.

Copyright ⓒ Aju Press All rights reserved.