According to LGES’ regulatory filing on Monday, the contract covers battery supply to Mercedes-Benz from March 2028 through June 2035, spanning both Europe and North America, the two fastest-growing EV markets.

The deal amounts to roughly 8 percent of LGES’ latest annual revenue of 25.62 trillion won, based on its 2024 consolidated financial statements.

At 10:10 a.m. shares of LGES jumped 4.5 percent to 445,000 won($303), far outperforming KOSPI gain of 0.2 percent.

LGES said the contract value, translated at the exchange rate of 1,471.5 won per dollar on Dec. 5, may be adjusted as details, including total volume and duration, remain subject to further negotiation with the German automaker.

The agreement contains no upfront deposits or advance payments, the filing added.

The Mercedes-Benz deal adds to a series of multibillion-dollar contracts LG Energy Solution has secured in 2025, underscoring its strengthened global positioning as the EV market bifurcates between premium automakers and cost-driven Chinese competitors.

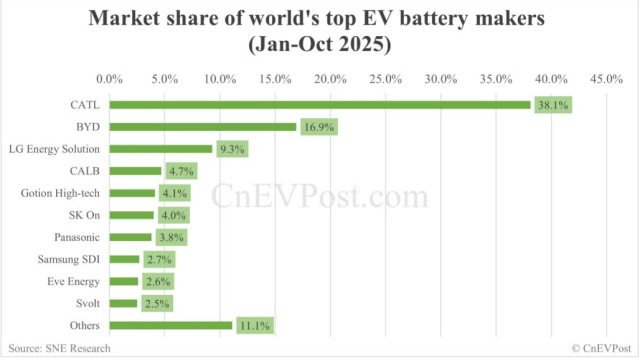

LGED maintains third rank in global EV battery market, following Chinese behemoths CATL and BYD. Its share however dropped to 9.3 percent as of October this year from 11.1 percent in the same period a year ago, according to Korean market research firm SNE Research.

Major LGES contracts announced so far this year include $4.3 billion battery supply deal with an undisclosed party in the United States in July, presumed to be Tesla, aside from exclusive U.S supply contracts with Hyundai Motor Group, Honda Motor, and General Motors.

Copyright ⓒ Aju Press All rights reserved.