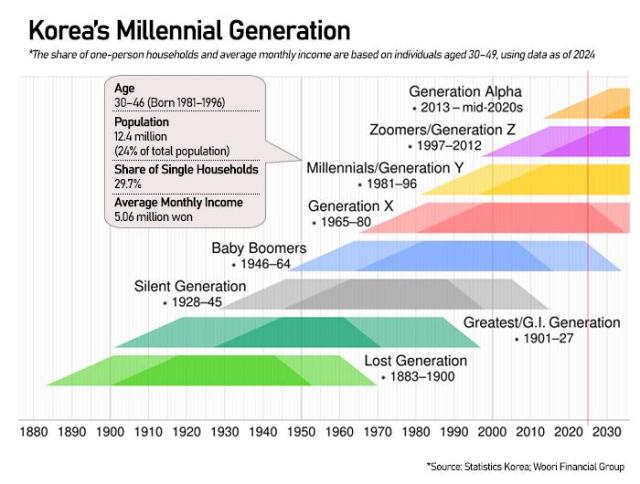

Grouped together with Gen Z under the shorthand "MZ generation," millennials are aging out of youth by any demographic measure. The youngest, born in 1996, will turn 30 next year; the oldest will be 45. But for a large share of this cohort, milestones traditionally associated with adulthood — stable employment, marriage, homeownership and child-rearing — remain delayed, constrained or out of reach, often against their will.

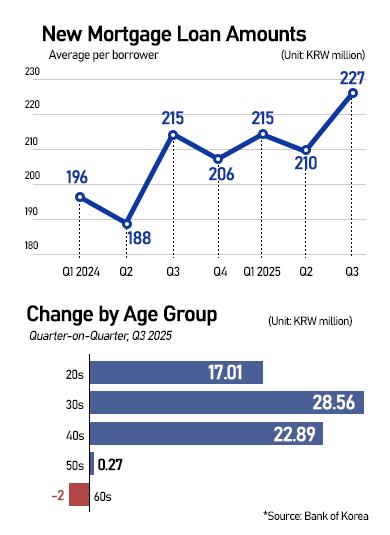

What millennials learned instead was that salaried income alone would not be enough. They self-taught, speculated and became the driving force behind Korea's asset boom, often fueled by leverage. The term "youngkkeul" — roughly meaning "maxing out loans to the soul" — was coined to describe their panic-driven borrowing, taken on in fear of being permanently shut out of homeownership and asset accumulation.

Yet ownership remains elusive. Only one in four households headed by people in their 30s lives in a home they own. The number of households without homes reached 527,729 last year in Seoul, an increase of 17,215 from the previous year and the highest figure since statistics began in 2015.

"Korea has traditionally had a middle-class myth," said Kim Yong-jin, a professor at Sogang University School of Business. "The core requirement of being middle-class is owning a home. Even if you can live comfortably without one, in Korea, homeownership is treated as a measure of success. That creates fundamental demand."

Behind the youngkkeul phenomenon lies a powerful fear of missing out. The belief that "if I don't buy now, I'll never own a home in Seoul" has hardened, pushing loan demand among people in their 30s toward high-priced areas with expensive housing and rents.

But not everyone can play this game. "Youngkkeul is only possible for those in their early 30s with stable, well-paying jobs," said Lee Chang-min, a professor at Hanyang University School of Business. "It's creditworthy professionals who can secure loans. Those who enter the workforce late, even in their 30s, often can't."

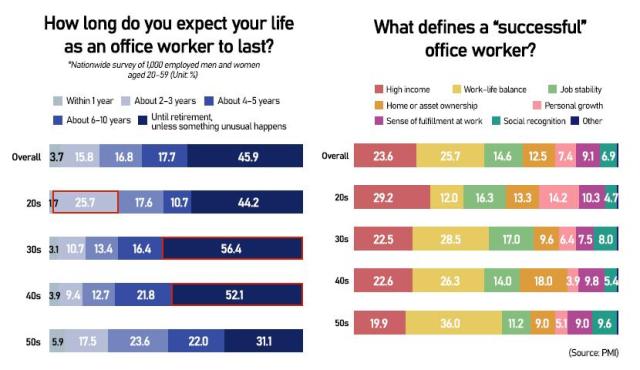

Despite high debt burdens, millennials remain deeply asset-oriented. In a real estate perception survey conducted last year by Woori Financial Group, 44.6 percent of Gen M respondents said real estate investment is essential to building wealth — the highest among generations. Gen Z recorded the lowest share at 36.8 percent. Unlike their younger counterparts, millennials favor asset and career stability over a carefree lifestyle.

Millennials also face an identity crisis unique to Korea's legal framework. Employment-related laws define youth as ages 15 to 29, while small business and employment insurance laws extend youth status to 34. In startups and agriculture, the cutoff stretches to 39 or even 40. As a result, many millennials remain administratively classified as "youth" long after society expects them to behave like adults.

That contradiction is becoming more visible in the labor market. According to employment trends released last month by Ministry of Data and Statistics, the employment rate for people aged 15 to 29 fell to 44.3 percent in November, down 1.2 percentage points from a year earlier — the lowest November reading in five years. At the same time, unemployment among people in their 30s surged nearly 30 percent year-on-year, underscoring mounting pressure on the broader "2030 generation."

Despite being labeled "youth," millions of millennials are not economically prepared to exit that category. No longer young, yet unable to arrive at adulthood, they occupy a prolonged in-between — carrying debt, delaying life decisions and redefining what growing up means in modern Korea.

Copyright ⓒ Aju Press All rights reserved.