SEOUL, Jan. 9 (AJP) - Foreign investors returned to the South Korean stock market, net purchasing over 9 trillion won in December alone, according to data released by the Financial Supervisory Service (FSS) on Friday.

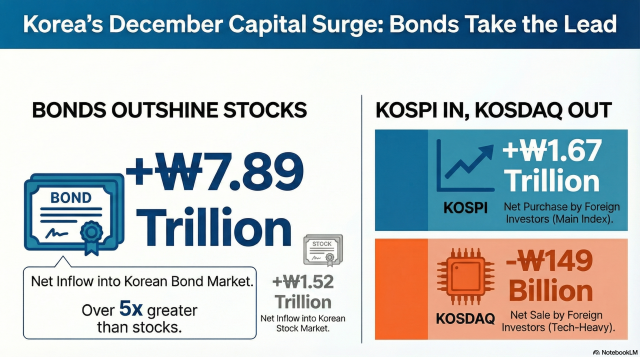

Foreigners snapped up 1.52 trillion Korean won (US$1 billion) in stocks and 7.89 trillion won in bonds, marking a decisive return after a brief retreat in November last year.

The appetite was concentrated on the KOSPI, with net purchases totaling 1.67 trillion won, even as the tech-heavy KOSDAQ saw a modest net outflow of 149 billion won.

The renewed interest lifted the total value of foreign-held stocks to 1,326.8 trillion won by the end of the year, up 134 trillion won from the previous month. Foreign holdings now account for 30.8 percent of the total market capitalization of the South Korean stock market.

European investors led the buying spree with a net 1.6 trillion won, followed by North American and Asian investors at 400 billion won and 300 billion won, respectively. By country, France and the U.K. were the most aggressive buyers, with net purchases of 1 trillion won and 800 billion won. Conversely, Singapore and the Cayman Islands offloaded 900 billion won and 600 billion won.

The U.S. remains the largest stakeholder, holding 546 trillion won worth of stocks or 41.2 percent of all foreign-owned shares. European investors follow with 417 trillion won, while Asian and Middle Eastern holdings stand at 182.4 trillion won and 22.9 trillion won.

The bond market also saw a robust influx of capital with foreign investors purchasing a net 17.53 trillion won. Even after 9.64 trillion won in matured holdings, net investment amounted to 7.89 trillion won. This pushed total foreign bond holdings to 328.5 trillion won, up 6.9 trillion won from November, accounting for 11.9 percent of all outstanding listed debt.

European investors led foreign bond inflows with 2.5 trillion won, followed by the Americas at 1.7 trillion won and Asia at 1.1 trillion won. In terms of total holdings, Asian investors maintain the largest share at 135.9 trillion won, followed by European holders at 120.6 trillion won.

Most of the investment went into government bonds and Monetary Stabilization Bonds (MSBs), which saw net purchases of 3.7 trillion won and 1.9 trillion won, respectively. As of the end of last year, foreign investors held 297.1 trillion won in government bonds and 31.4 trillion won in other bonds.

Copyright ⓒ Aju Press All rights reserved.