SEOUL, January 13 (AJP) - After extracting concessions from Japan and South Korea, U.S. President Donald Trump is now pressing another semiconductor powerhouse — Taiwan — using trade leverage to pull advanced chip manufacturing onto U.S. soil.

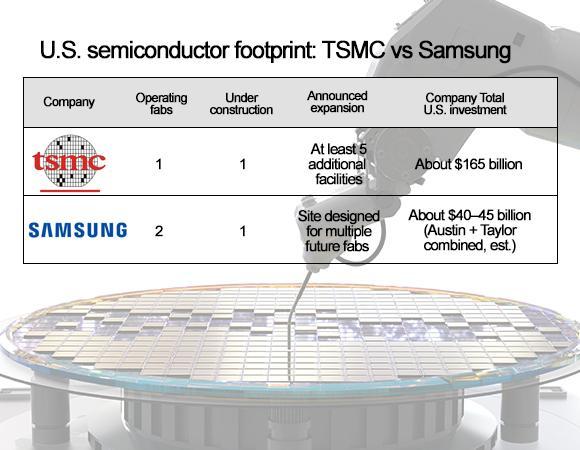

Under an emerging deal, Washington plans to cut tariffs on Taiwanese goods to 15 percent from 20 percent in exchange for a major expansion of Taiwan Semiconductor Manufacturing Co.’s U.S. manufacturing footprint, according to a report by The New York Times. TSMC would commit to building at least five additional semiconductor facilities in the United States.

The arrangement reflects Trump’s broader strategy of tying trade relief to domestic investment, particularly in industries deemed critical to national security. U.S. officials have indicated that companies expanding production in America could be exempted from potential national-security tariffs imposed under Section 232 of U.S. trade law.

For TSMC, the deal would significantly accelerate its transformation of Arizona into a mega-cluster for advanced chips. The Taiwanese chipmaker is already operating one plant in the state and is completing a second scheduled to open in 2028, with more fabs planned for the late 2020s. The new commitment would lift TSMC’s total U.S. investment to an estimated $165 billion, covering advanced manufacturing, packaging facilities and research centers.

Samsung Electronics, TSMC’s closest rival in contract chipmaking, has a smaller but expanding U.S. presence. The Korean tech giant operates two fabs in Austin, Texas, and is preparing to begin production at a new foundry in Taylor, Texas, where it has shifted its focus to next-generation two-nanometer technology. The Taylor site is designed to accommodate multiple fabs, though only one is currently nearing completion.

The widening gap in U.S. capacity between the world’s two largest foundries comes at a sensitive moment for South Korea. The country’s semiconductor exports hit a record $173.4 billion last year, with shipments to the United States accounting for nearly one-fifth of the total amid surging demand for AI-server memory.

Industry watchers say the Trump-TSMC deal could pull Korea’s chipmakers in opposing directions.

On one hand, rising geopolitical and tariff risks surrounding Taiwan may prompt major U.S. customers to diversify supply chains, potentially benefiting Samsung’s foundry business as an alternative production base.

On the other, TSMC’s push to build a fully integrated “all-in-U.S.” ecosystem — spanning manufacturing, advanced packaging and R&D — is expected to further lock in American customers, raising barriers for rivals seeking new contracts.

The policy shift is also likely to intensify competition for investment dollars. If the U.S. manufacturing race accelerates, Korean chipmakers may need to significantly increase North American capital spending beyond current plans, adding pressure to cash flow at a time when the industry is already investing heavily in advanced packaging and high-bandwidth memory for artificial-intelligence systems.

For now, officials in Seoul are closely watching how Washington formalizes the deal — particularly the scope of tariff exemptions under Section 232 and how U.S. authorities define a qualifying “facility.”

Those details could determine whether Trump’s Taiwan chip “big deal” becomes a catalyst for broader supply-chain diversification — or a turning point that further entrenches TSMC’s dominance on American soil, forcing Korea’s chip champions to rethink their long-term strategy.

Kim Yang-paeng, a senior researcher at the Korea Institute for Industrial Economics and Trade, said it was difficult to draw a direct line between Washington’s demands on Taiwan and their impact on South Korea, but warned of growing pressure on the global semiconductor ecosystem.

“The fact that the U.S. is asking Taiwan to build more fabs does not necessarily mean the same demands will automatically apply to South Korea,” Kim said. “Korea already has broader industrial cooperation with the United States in areas such as shipbuilding and automobiles, which puts it in a different position from Taiwan.”

Still, he cautioned that a rapid expansion of TSMC’s U.S. manufacturing capacity could exacerbate oversupply risks and accelerate the shift of global semiconductor production toward America.

“If the U.S. increasingly becomes the center of chip manufacturing,” Kim said, “the room for Korea to expand its foundry business over the long term could narrow.”

Copyright ⓒ Aju Press All rights reserved.