SEOUL, January 29 (AJP) - South Korea’s two dominant memory-chip makers, Samsung Electronics and SK hynix, have formally entered the race for next-generation high-bandwidth memory, or HBM4, as demand from artificial-intelligence chipmakers tightens an already constrained market.

The companies, which together command roughly 80 percent of high-bandwidth memory used in AI accelerators, held back-to-back earnings conference calls on the same day for the first time, offering competing visions of how the next phase of the AI-driven memory cycle will unfold.

Both projected sustained supply tightness this year despite aggressive capacity expansion, following record earnings in 2025.

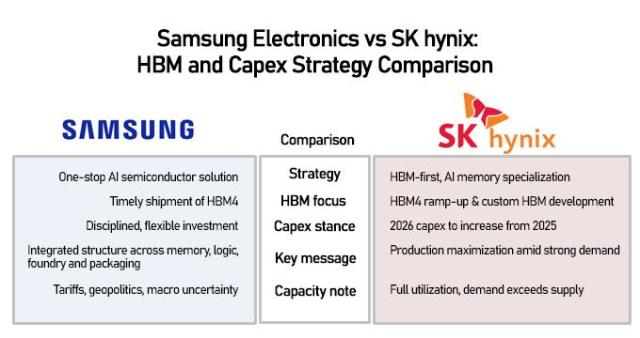

The rivalry centers on HBM4, the next standard for AI memory, where Samsung is newly entering the supply chain of Nvidia after SK hynix enjoyed a near-monopoly position in earlier generations.

SK hynix, which pioneered the HBM market and delivered an industry-leading 58 percent operating margin from chip sales in the fourth quarter, expressed confidence that its technological lead would carry into the next cycle.

“Our commercialization capabilities and product quality, which have earned customer trust, cannot be overtaken in a short period,” said Song Hyun-jong, president of SK hynix’s corporate center. “As with HBM and HBM3, we aim to secure overwhelming leadership in HBM4.”

Samsung, which plans to roll out 11.7-gigabits-per-second HBM4 products as early as next month, said demand is already outstripping supply. Orders for 2026 have exceeded the company’s current capacity, executives said, with key customers seeking advance bookings for 2027 deliveries.

“Despite continued expansion, our capacity cannot keep up with demand,” said Kim Jae-june, executive vice president of Samsung’s memory division, adding that HBM revenue this year is expected to more than triple from 2025 levels.

Both companies pledged a “significant” ramp-up in capacity this year compared with 2026, though neither disclosed precise figures. SK hynix said it remains comfortable committing capital investment equivalent to roughly 30 percent of this year’s projected revenue.

Samsung said it will respond to customer demand through timely shipment of competitive HBM4 products while expanding sales of AI-related memory and addressing rising NAND demand linked to AI workloads.

For now, the competitive gap is already visible in financial results. Samsung posted strong operating income and record sales in the fourth quarter and full year of 2025, but lagged SK hynix in profitability.

Samsung reported 16.4 trillion won in chip operating profit for the December quarter, while SK hynix generated 19.17 trillion won on sales of 80.8 trillion won, yielding the industry’s highest margin.

For full-year 2025, Samsung recorded 24.9 trillion won in chip operating profit, compared with SK hynix’s 47.2 trillion won on sales of 97.15 trillion won, underscoring the advantage of SK hynix’s heavier exposure to AI-related, high-margin memory.

Kim Duk-ki, a professor of electronic engineering at Sejong University, said the surge in memory profitability reflects AI-driven demand outpacing supply, but warned that overly rapid investment expansion could reintroduce volatility in a historically cyclical industry.

“If capital spending accelerates too quickly, price instability could eventually follow,” he said.

Market analysts largely expect SK hynix to retain its lead. Counterpoint Research estimates the company will account for about 54 percent of global HBM4 sales this year, compared with 28 percent for Samsung and 18 percent for Micron. The firm previously held 62 percent of HBM3 shipments as of mid-2025.

Goldman Sachs expects SK hynix to maintain a comfortable lead in HBM3 through at least 2026, while UBS forecasts the company could capture around 70 percent of the HBM4 market tied to next-generation AI platforms, including Nvidia’s Rubin architecture.

Samsung Electronics shares closed down 0.7 percent at 161,300 won on Thursday, while SK hynix climbed 2.7 percent to 864,000 won, reflecting investors’ contrasting reactions to the two chipmakers’ earnings and outlook.

For now, Samsung’s entry marks a meaningful escalation in competition. But in the early stages of the HBM4 cycle, investors and customers alike appear to see the pioneer as remaining firmly in front.

* AJP Yuna Ryu and Yoo Joonha contributed to this story.

Copyright ⓒ Aju Press All rights reserved.