SEOUL, January 30 (AJP) -South Korea remained on the U.S. Treasury Department’s currency Monitoring List in its latest semiannual report, on widened external surpluses and sizeable bilateral trade imbalance with the United States, while finding the Korean won's weakness "not in line with" the country's "strong fundamentals.

In its January 2026 Report to Congress on the Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States released on Thursday, the U.S. Department of the Treasury said no major trading partner met all three statutory criteria for designation as a currency manipulator during the review period, covering the four quarters through June 2025.

“Treasury concludes that no major trading partner of the United States engaged in conduct of the kind described in Section 3004 of the 1988 Act,” the report said, referring to the law governing findings of currency manipulation for competitive advantage.

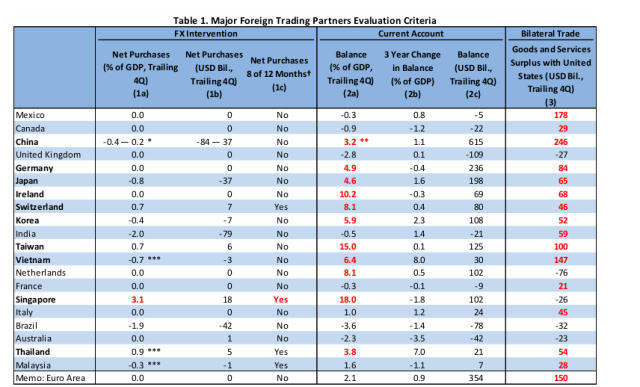

Still, South Korea was kept on the Monitoring List because it met two of the three thresholds set out under the 2015 Trade Facilitation and Trade Enforcement Act: a material current account surplus and a significant bilateral trade surplus with the United States. Countries meeting two criteria are subject to enhanced scrutiny for at least two consecutive reports to ensure improvements are durable rather than temporary.

Along with South Korea, the Monitoring List includes China, Japan, Taiwan, Thailand, Singapore, Vietnam, Germany, Ireland and Switzerland.

South Korea returned to the list in November 2024 after a brief leave in 2023 for the first time in seven years.

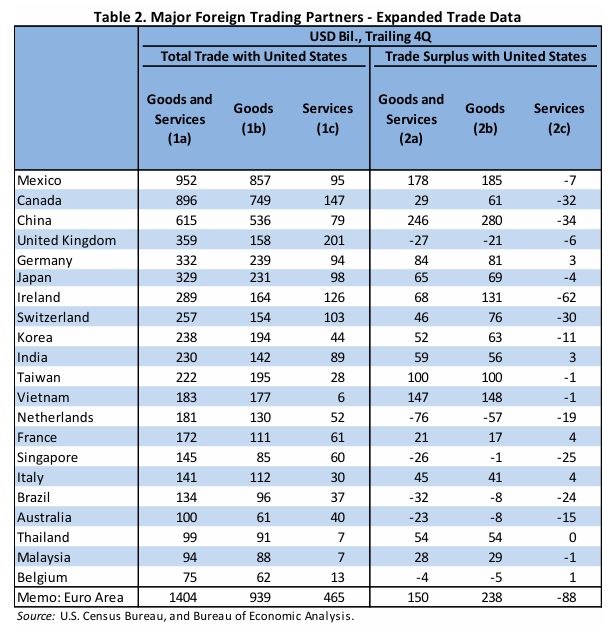

According to the report, Korea’s current account surplus rose to 5.9 percent of GDP over the review period, up from 4.3 percent a year earlier, driven almost entirely by goods trade — particularly semiconductors and other technology exports.

Korea’s goods and services surplus with the United States also expanded sharply, reaching $52 billion, more than double its pre-pandemic high of $18 billion in 2016.

Despite these strong external positions, the Korean won came under sustained depreciation pressure in late 2024 and 2025. Treasury noted that the won’s weakness was “not in line with Korea’s strong economic fundamentals,” attributing much of the pressure to private-sector capital outflows rather than policy actions.

Retail investors and institutional funds accelerated overseas equity purchases, while the National Pension Service (NPS) continued large-scale foreign investment as part of its diversification strategy. Treasury described these outflows as a key factor behind won depreciation.

The report said Korean authorities sold $7.3 billion in foreign exchange reserves on a net basis during the review period — about 0.4 percent of GDP — primarily to smooth excess volatility rather than to push the currency in a particular direction.

Treasury assessed Korea’s foreign-exchange intervention since 2016 as “broadly symmetrical,” marking a departure from earlier practices aimed at resisting appreciation. The Bank of Korea has reported net sales in most quarters since it began regular disclosure in 2019, largely during periods of dollar strength.

The report also highlighted expanded transparency commitments made in a September 2025 joint statement between Seoul and Washington, including monthly disclosure of intervention data and more detailed reporting of foreign-exchange reserves and forward positions in line with International Monetary Fund standards.

Treasury pointed to demographics and savings behavior as structural drivers of Korea’s persistent surplus. Rapid population aging has raised precautionary savings, while households and institutions channel funds overseas in search of higher returns, reflecting limited dividend payouts and low valuations in domestic equity markets.

In its most recent assessment, the IMF judged Korea’s external position to be broadly in line with medium-term fundamentals, estimating the won to be undervalued by about 2.4 percent on a real effective basis in 2024. An updated IMF assessment for 2025 has yet to be released.

While Korea avoided any escalation toward enhanced enforcement, Treasury said it would continue to closely monitor the country’s exchange-rate practices and macroeconomic policies, particularly as large trade surpluses persist alongside currency weakness.

Copyright ⓒ Aju Press All rights reserved.