That pivot is now paying dividends as surging demand from AI data centers, along with Western efforts to diversify supply chains away from China, creates fresh openings for Korean players.

The long-term supply agreement announced Monday covers batteries for Mercedes-Benz's North American and European production lines from March 2028 to June 2035.

It follows CEO Ola Källenius's meeting with LG Group leaders in Seoul last month, where he signaled a more balanced supply-chain strategy to support Mercedes-Benz's plan to launch more than 40 new models by 2027 under a cost-conscious electrification drive.

While both sides declined to disclose the battery chemistry, industry analysts widely believe the order targets affordable EV lineups and will likely involve lithium iron phosphate (LFP) cells — a segment China has effectively controlled for nearly a decade.

"This is a long-awaited order from Europe and a win against heavy Chinese presence such as CATL," said Yoo Ji-woong, an analyst at Daol Investment & Securities.

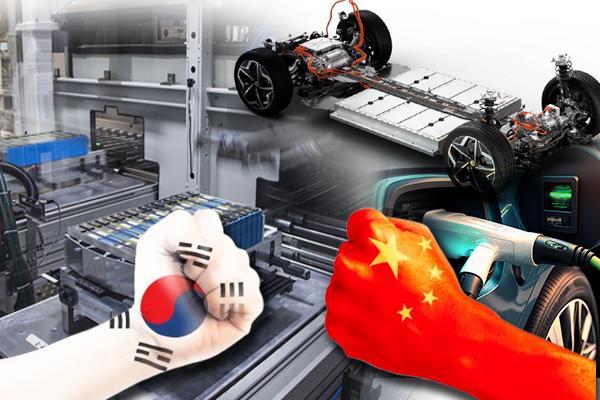

China invested aggressively in LFP early, securing more than 80 percent of global production and relegating Korean makers to higher-end, nickel-rich cells.

As of October 2025, Chinese producers controlled nearly 69 percent of global EV battery installations, according to SNE Research. CATL holds 38.1 percent alone — more than quadruple LG Energy Solution's 9.3 percent share — and Korea's battery trio of LG Energy Solution, Samsung SDI, and SK On has seen its combined market share slip from above 30 percent in 2021 to 23.8 percent in the first half of this year.

Yet Korea's long-delayed reentry into the LFP segment has gained traction precisely where the chemistry is booming: in energy storage systems (ESS).

LFP has become the preferred platform for storing solar and wind power due to its lower thermal-runaway risk and long cycle life. The rise of AI data centers, which require unprecedentedly stable and heavy power loads, is accelerating this shift. SNE Research forecasts the global ESS market to grow sixfold from 185 GWh in 2023 to 1,232 GWh by 2035.

Korean battery companies are positioning themselves aggressively. LG Energy Solution began mass-producing LFP cells for ESS at its Michigan plant in June and plans to expand capacity there to 30 GWh by year-end.

Its joint venture with Stellantis in Canada will also convert some nickel manganese cobalt (NMC) lines to LFP for ESS. Samsung SDI plans to convert its Stellantis JV factory in the United States to ESS production with a 30 GWh annual target by end-2025 and is expected to supply Tesla with more than 3 trillion won worth of ESS batteries over three years, delivering about 10 GWh annually.

SK On, meanwhile, secured a 1 GWh ESS supply deal in the United States in September and will convert part of its Georgia plant to fulfill the order, with additional line conversions under review depending on demand.

Geopolitical shifts are amplifying these opportunities. The United States now imposes more than 45 percent in combined tariffs on Chinese EV lithium-ion batteries — a 25 percent Section 301 duty plus two separate 10 percent levies tied to fentanyl enforcement and reciprocal trade measures following the Trump–Xi summit in Busan.

The European Union has added tariffs of up to 35 percent on Chinese EVs, atop its preexisting 10 percent duty, and is reviewing whether to widen tariff coverage to lithium-ion battery imports.

To capture this opening, LG Energy Solution and Samsung SDI plan to install LFP production lines at their U.S. plants co-owned with General Motors, marking the Korean battery makers' full-scale entry into a chemistry they long avoided.

LG has also announced plans to begin domestic LFP production at its Ochang plant by 2027. Global EV battery installations outside China rose 28.5 percent year-on-year to 377.5 GWh in the first ten months of 2025, according to SNE Research — evidence that demand remains strong in markets where Korean suppliers compete on quality and tariff-free access.

Copyright ⓒ Aju Press All rights reserved.