Japanese R-rated animated films dominated domestic box offices, while local streaming releases struggled to gain traction against international blockbusters such as "KPop Demon Hunters."

Industry observers warn that if Netflix's reported pursuit of Warner Bros. Discovery (WBD) materializes, Korean originals could be further crowded out, accelerating a shift toward platform-driven franchises at the expense of the genre-blending experimentation that once defined the global rise of Korean content, from "Parasite" to "Squid Game."

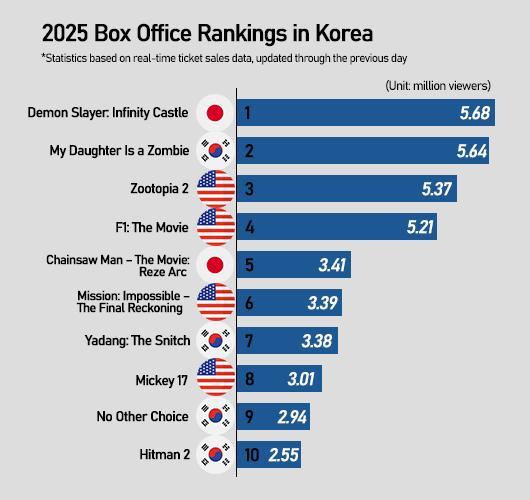

In cinemas, Japanese animation provided rare relief for exhibitors. According to year-end box office rankings, "Demon Slayer: Infinity Castle" topped the charts, drawing around 5.68 million viewers, while Korean releases struggled to produce a comparable breakout.

"Chainsaw Man: Reze Arc" alone surpassed 3.41 million admissions, ranking fifth overall and sustaining strong momentum throughout its run. The animation boom was fueled largely by Japanese manga IP and a loyal adult fan base — particularly viewers in their 40s and under — tied to the fandom surrounding shonen franchises such as "Demon Slayer," "Jujutsu Kaisen" and "Chainsaw Man."

The result was a paradoxical year: theaters benefited from animation's revival, but Korean films were not central to the recovery.

On streaming platforms, "KPop Demon Hunters" towered over competitors in the second half of the year. Despite being steeped in Korean themes — K-pop, food, beauty, tradition, and lifestyle — Korea can claim little industrial credit for its success.

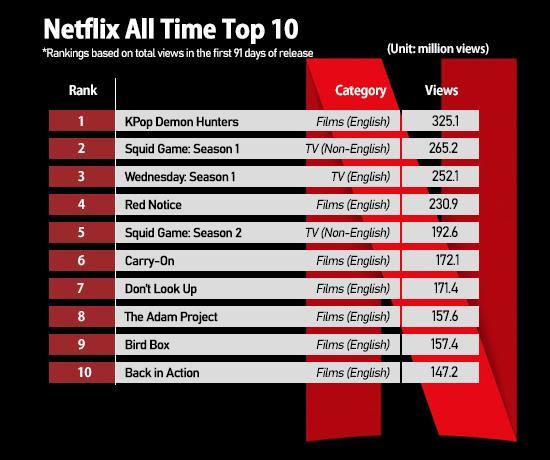

Netflix's Tudum data, which tracks views in the first 91 days, showed the film ranked No. 1 across all film and TV categories globally in 2025, outperforming both English- and non-English-language titles. It surpassed flagship series such as "Squid Game" and "Wednesday" in raw viewership.

Netflix said the film recorded 325.1 million views, becoming the first title on the platform to cross the 300 million mark. Its soundtrack, led by "Golden," peaked at No. 5 on the Billboard Hot 100 this week and remained on the chart for 24 consecutive weeks despite seasonal competition from Christmas classics. International media hailed the phenomenon as "a new chapter for K-content and K-pop."

From an industrial perspective, however, the film is fundamentally an American production. It was produced by Sony Pictures Animation, with Netflix handling distribution and full investment. According to foreign media reports, including Forbes, the production budget was around $100 million, while Sony's earnings — earned without direct investment — are estimated at roughly $20 million. Netflix, which controls the intellectual property, is expected to extract long-term value exceeding $1 billion through future exploitation.

The film's success underscored the limits of this year's K-content narrative. Produced in English for a global audience, "KPop Demon Hunters" traveled well — but it did not redefine Korean storytelling in the way earlier Korean-language works once did.

Still, Korean filmmakers showed they have not lost their creative instincts.

One of the year's most unexpected successes was "My Daughter Is a Zombie," a homegrown comedy that defied a market dominated by franchises and imported animation. It became the first Korean release of 2025 to surpass 5 million admissions, while also setting records for advance ticket sales and the strongest opening ever for a Korean comedy.

Adapted from cartoonist Lee Yun-chang's popular Naver webtoon series of the same name (2018–2020), the film stayed faithful to the tone and emotional appeal of the original work. Its success revived the communal theatrical experience, drawing audiences back into cinemas to laugh, cry and react together.

At the other end of the spectrum stood "No Other Choice," the latest film by internationally acclaimed director Park Chan-wook. While not positioned as a mass-market blockbuster, the film reaffirmed the enduring pull of globally recognized Korean auteurs, attracting audiences driven by artistic credibility rather than scale or spectacle.

"Both K-pop and Korean cinema felt as though they were in a cooling phase overall," culture critic Kim Herin-sik said. "In theaters, films largely lost their presence to animation. At the same time, there was some progress among independent films, including works by director Yoon Ga-eun, suggesting the industry may need to reorganize around smaller-scale productions."

"If 'No Other Choice' goes on to win major awards," he added, "it could help reverse the overall mood."

Despite these challenges, Korean titles continue to maintain a strong presence in an English-heavy streaming landscape.

Among Netflix's global top-10 titles ranked by views in the first 91 days, eight were English-language productions. The only two non-English titles on the list were both Korean, led by "Squid Game."

The contrast reflects the enduring dominance of English-language content, while also confirming sustained global demand for Korean storytelling when cultural specificity translates effectively across markets. "Squid Game" resonated by pairing universal themes — economic inequality and class tension — with distinctly Korean elements such as childhood games including "Red Light, Green Light" and "gonggi."

The tension has sharpened as Netflix signals a new phase of consolidation following reports earlier this month regarding a potential acquisition of WBD.

If completed, such a deal would fundamentally reshape the global streaming landscape. Netflix would not only consolidate market share but also absorb a vast production apparatus, including WBD's intellectual property — from the "Harry Potter" franchise to HBO flagships such as "Game of Thrones" and "Friends."

Industry observers warn that deeper consolidation could accelerate the platformization of content production, making it increasingly difficult for studios to maintain independent voices. For many, a partnership or merger may become the only viable path to survival.

Amid these shifts, domestic players show mixed signals.

CJ ENM posted improved results in the third quarter of 2025, supported by theatrical revenue from "No Other Choice" and stronger exports driven by expansion into new markets such as Latin America and the Middle East. Revenue rose across film, drama, music and commerce divisions, signaling a broad-based recovery.

According to a regulatory filing in November, CJ ENM reported operating profit of 17.6 billion won ($12 million), up 11 percent year-on-year. The company also entered a strategic partnership with WBD to jointly produce K-content — a move that gained added significance as WBD later emerged as a potential acquisition target for Netflix.

Attention also briefly turned to a proposed merger between domestic streaming platforms TVING and WAVVE, viewed by some as a counterweight to global players. The process, however, stalled due to opposition from key shareholder KT, which cited concerns about potential damage to its IPTV business.

With a merger now likely pushed into 2026, the two platforms have pursued merger-level cooperation — including a joint subscription package and integrated advertising platform — even as they continue to stress the urgency of competing with Netflix.

Copyright ⓒ Aju Press All rights reserved.

![[INTERVIEW] Media company head urges active promotion of K-content abroad](https://image.ajunews.com/content/image/2020/06/25/20200625164353379411_278_163.jpg)