SEOUL, December 24 (AJP) - South Korea’s consumer confidence fell in December as inflationary expectations rose amid persistent weakness in the won, survey data showed Wednesday.

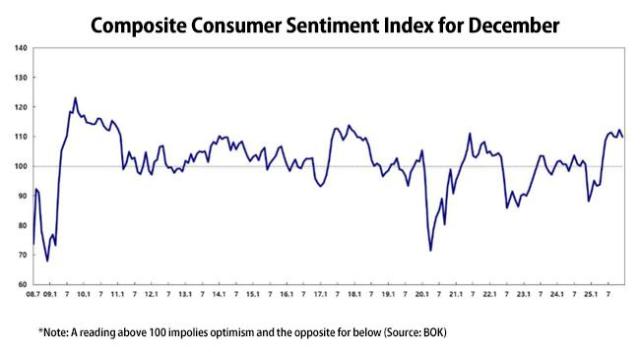

The composite consumer sentiment index (CCSI) for December dropped 2.5 points from November to 109.9, according to the Bank of Korea.

While a reading above 100 indicates that optimism outweighs pessimism, several subindices pointed to growing household anxiety over economic conditions.

The index measuring perceptions of current domestic economic conditions fell 7 points to 89, while the outlook for the next six months dropped 6 points to 96. The declines suggest a rising share of consumers believe conditions have deteriorated compared with six months earlier and remain uncertain about the near-term outlook.

Employment sentiment also weakened. The employment opportunity index slid 3 points to 92, reflecting a cooling labor market as the number of “idled” young people surpassed 700,000 for the first time, according to data from Statistics Korea.

Expectations for higher borrowing costs strengthened.

The prospective interest rates index rose 4 points to 102, signaling broad expectations that the central bank could raise rates within the next six months.

Analysts pointed to persistent hawkish signals from U.S. Federal Reserve Chair Jerome Powell and the tightening cycle in Japan as key drivers.

Inflation concerns remained dominant. The prospective prices index rose 2 points to 148, reflecting widespread expectations that prices will continue to climb over the next year.

The sentiment aligns with November consumer price data, which showed inflation rising 2.4 percent — the third straight month above the 2 percent level.

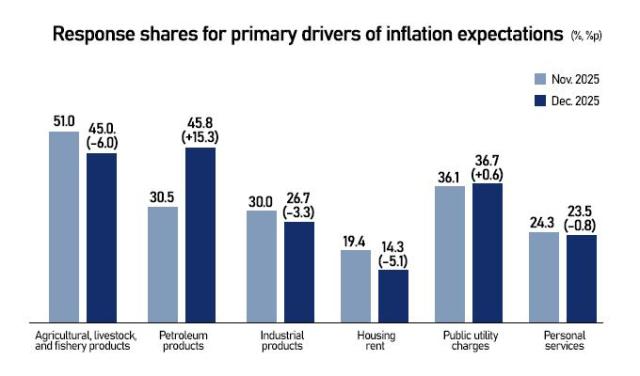

Households cited fuel prices (45.8 percent), fresh food prices (45.0 percent), and utility costs (36.7 percent) as the main sources of inflation pressure, exacerbated by higher import prices as the won hovers near one of its weakest annual averages on record.

Housing price expectations also firmed. The prospective housing prices index edged up 2 points to 121, underscoring the limited effectiveness of government measures to cool the Seoul property market.

According to the Korea Real Estate Board, Seoul apartment prices had risen 8.25 percent as of Dec. 15, the fastest pace since the agency began compiling the data.

By contrast, wage expectations softened. The prospective wages index slipped 1 point to 122, limiting households’ ability to offset rising living and housing costs.

Perceptions of living standards also deteriorated. The current living standards index stood at 95 and the outlook index at 100, both down 1 point from the previous month.

While the prospective household income index fell 1 point to 103, the expected household spending index remained unchanged at 110, suggesting many consumers see little room to cut spending despite stagnant income growth.

Copyright ⓒ Aju Press All rights reserved.