“Both South Korea and Germany are automotive manufacturing nations,” said Stephen Fuhr, Canada’s special envoy for defense procurement, during tours of Korean defense manufacturers and talks with senior officials.

“If there are areas where we can cooperate in sectors like automobiles, we are looking to pursue broader partnerships that go beyond defense,” he said.

Fuhr made the point explicit after touring the Jang Yeong-sil, a KSS-III submarine undergoing sea trials, reiterating that the decisive criterion in selecting a CPSP contractor would be which country delivers the greatest industrial benefits to Canada.

The message comes as the government of Mark Carney moves to stabilize Canada’s auto sector amid U.S. tariffs and uncertainty over the review of the USMCA trade pact this year.

U.S. President Donald Trump last year imposed 25 percent tariffs on Canadian vehicles and parts, a shock to an industry that exports about 90 percent of its output to the U.S. Since then, thousands of workers have been laid off as major automakers, including General Motors and Stellantis, scaled back production.

Carney’s government has responded with financial incentives for manufacturers, tariff credits tied to domestic production and the reintroduction of EV buyer rebates, as Ottawa seeks to diversify industrial partnerships beyond the U.S.

Against that backdrop, officials say submarine bids are being judged not only on military performance but also on their potential to reinforce supply chains, investment and employment.

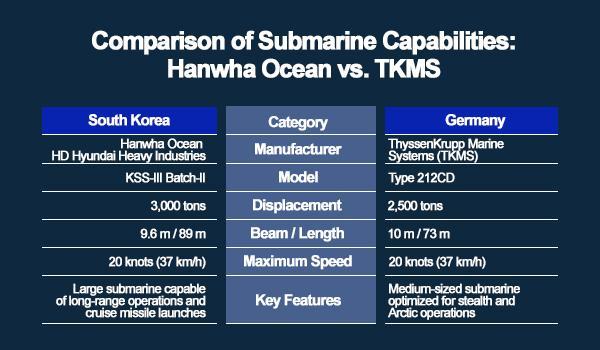

From a technical standpoint, South Korea’s proposed KSS-III Batch-II, developed by Hanwha Ocean, is widely assessed as more heavily armed and mature than Germany’s Type 212CD offered by ThyssenKrupp Marine Systems (TKMS).

The KSS-III displaces about 3,000 tons and is equipped with 10 vertical launch system cells for long-range precision strikes. It has already entered service with the Republic of Korea Navy, allowing Fuhr to physically tour the submarine during ongoing sea trials.

By contrast, the Type 212CD remains at the design and construction stage, with the first vessels for Germany and Norway not scheduled for delivery until 2029 and the early 2030s.

The German submarine, displacing around 2,500 tons, uses hydrogen fuel-cell air-independent propulsion optimized for cold and Arctic waters but lacks vertical launch capability.

Canadian officials, however, say platform performance accounts for only a fraction of the final evaluation, with fleet sustainability and economic return carrying the greatest weight.

That assessment has been reinforced by Fuhr, who has stressed that CPSP is a strategic industrial decision as much as a naval acquisition.

Germany enters the race with a notable advantage through Volkswagen’s multi-billion-dollar battery and EV investment in Canada, which Berlin has aligned with its defence bid to underline long-term industrial integration.

The Korean side has also emphasized high-level economic diplomacy. Team Korea, led by presidential chief of staff Kang Hoon-sik, included Hyundai Motor Group Chairman Chung Eui-sun in recent outreach to Ottawa.

But analysts note that Hyundai Motor Group faces structural constraints. With a large EV complex already operating in Georgia, the commercial case for building a full-scale plant in Canada remains uncertain.

Seoul has instead promoted broader industrial cooperation, including recent bilateral arrangements aimed at encouraging Korean automotive and future-mobility investment in Canada.

Kang met on Friday with Fuhr in just over a week at the Cheong Wa Dae in line with President Lee Jae Myung’s directive to accord special diplomatic courtesy to visiting Canadian officials.

“Many people are hoping for a positive result from this project, and we are well aware of those expectations,” Kang wrote in a Facebook post after the talks. “However, this is by no means an easy situation.”

“Although the circumstances are difficult, the government and companies will work together as one team and do their utmost until the very end,” he added.

South Korea is also positioning its submarine proposal within a broader defense-industrial partnership as Canada accelerates army modernization and seeks domestic manufacturing capacity.

Hanwha Aerospace has highlighted its willingness to invest locally, citing its armored vehicle production hub in Australia as a model for a Canadian facility that could generate jobs and support technology transfer.

Germany, meanwhile, has expanded its offer to include joint research and workforce development, seeking to appeal to Ottawa through advanced R&D cooperation as well as platform delivery.

With final bids due by March 2, both camps are now treating auto-sector cooperation as a core offset battleground — one shaped increasingly by Canada’s industrial vulnerability under U.S. trade pressure.

“The key question,” Fuhr said during his visit to Hanwha’s Geoje shipyard, “is who can offer the best economic opportunity for Canada.”

Canada’s CPSP aims to replace the Royal Canadian Navy’s aging Victoria-class fleet, which is scheduled for decommissioning in the mid-2030s.

In July 2024, Ottawa announced plans to procure up to 12 conventionally powered, under-ice capable submarines, followed by a request for information in September that year. The government expects to award a contract by 2028, with the first new vessel delivered no later than 2035.

The program is closely linked to Canada’s updated defense strategy, which prioritizes Arctic security as climate change makes northern waters more accessible to external powers, including Russia and China.

Germany and Norway are jointly building six Type 212CD submarines, with deliveries beginning in 2029. South Korea’s Hanwha Ocean and HD Hyundai Heavy Industries have formed a “One Team” partnership to offer the KSS-III, with the first four units proposed for delivery by 2035.

Korea has also pitched lithium-ion battery propulsion, extended underwater endurance and comprehensive crew training and maintenance facilities on both Canadian coasts.

Beyond capability, Ottawa is seeking a partner with robust global supply chains to avoid a repeat of the Victoria-class’s “orphan fleet” problem, which has complicated maintenance and parts procurement for decades.

Copyright ⓒ Aju Press All rights reserved.