According to a client note from Goldman Sachs, hedge funds bought a record amount of Asian stocks in the week to Friday, targeting both developed and emerging markets. Inflows were concentrated in Korea, Taiwan and China, while India saw modest selling. Exposure to Asian equities reached its highest level since at least 2016.

The surge came despite renewed global volatility driven by concerns over massive investment in artificial intelligence and its impact on corporate earnings. While major world indices fell sharply on Friday, Asian markets remained resilient.

Japan’s Nikkei and Taiwan’s benchmark index each gained about 5 percent last week, while South Korea’s KOSPI jumped more than 8 percent. The S&P 500 was down 0.19% so far this year, while the Nasdaq has fallen 2.77%, according to data from the Financial Supervisory Service (FSS).

The KOSPI has emerged as one of the world’s strongest-performing equity markets in 2026. The benchmark is up 30.68 percent year to date, far outpacing the Nikkei 225's 13.12 percent, Taiwan’s 16.03 percent, and the MSCI Emerging Markets Index's 11.83 percent.

The KOSPI has more than doubled since the end of 2024, driven largely by surging semiconductor stocks.

Samsung Electronics and SK hynix have rallied about 51 percent and 35 percent, respectively, this year as they are expected to continue with red-hot earning streak fueled by AI boon. Compared with the beginning of 2025, SK hynix's stock is 5 times more expensive and Samsung Electronics' more than tripled.

Once-in-Four-Decades Memory Shortage

A key driver behind Korea’s rally is what semiconductor research firm SemiAnalysis describes as a “once-in-four-decades” memory shortage.

In a recent report, SemiAnalysis said memory prices are doubling again and that the current supercycle is larger and longer than previous booms, driven by structural supply constraints and explosive AI-related demand.

Unlike past cycles, today’s memory industry is no longer able to expand supply rapidly. Physical limits have slowed DRAM scaling, making further cost reductions increasingly difficult and expensive. At the same time, building new fabs requires multi-billion-dollar investments and multi-year timelines.

As a result, bit output per wafer is no longer rising fast enough to offset demand growth.

Supply growth is being constrained not only by capital discipline, but by physics and process complexity, the report said.

As each new generation of accelerators requires substantially more DRAM and high-bandwidth memory, creating a persistent supply-demand mismatch that is expected to last through at least 2027, it predicted.

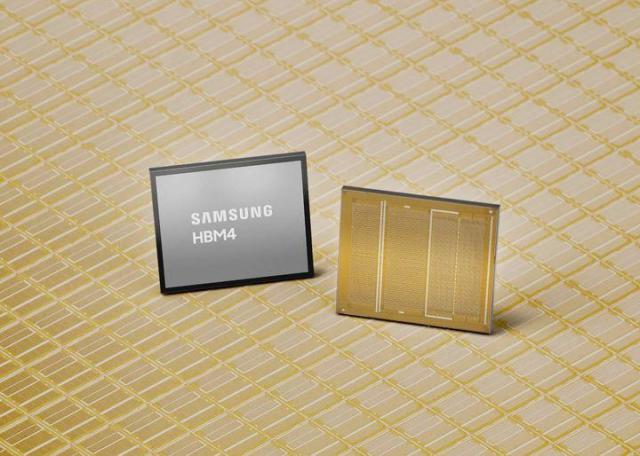

Samsung Electronics and SK hynix together control much of the global supplies of DRAM and high-bandwidth memory powering AI accelerators and hyperscale data centers.

SK hynix leads the market for high-bandwidth memory used in AI accelerators, while Samsung remains a key supplier of advanced DRAM nodes.

Overall, overseas investors have sold a net 13.5 trillion won worth of KOSPI shares so far this year and 10.0 trillion won in February alone, according to FSS data.

Still, multinational investment banks are bullish on further gains.

Goldman Sachs raised the KOSPI target to 6,400, or 20 percent upside.

Copyright ⓒ Aju Press All rights reserved.