President Donald Trump welcomed the announcement, publicly praising Tokyo’s commitment and reiterating his March 19 invitation to the Japanese leader, whose political authority was recently reaffirmed through a high-stakes snap election.

The rollout marks the first major tranche under Prime Minister Sanae Takaichi’s U.S.-focused investment strategy, which links capital deployment directly to diplomatic and trade objectives.

Infrastructure-focused investment package

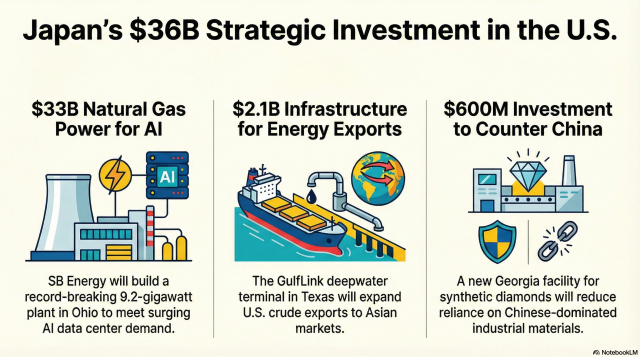

At the core of the package is a $33 billion natural gas power plant in Portsmouth, Ohio, led by SB Energy, a subsidiary of SoftBank Group. The 9.2-gigawatt facility is expected to become the largest of its kind in U.S. history and is designed to address surging electricity demand from AI data centers.

Additional projects include a $2.1 billion investment in the GulfLink deepwater oil export terminal off Texas, aimed at expanding U.S. crude exports to Asia, and a $600 million synthetic diamond facility in Georgia by De Beers’ Element Six, intended to strengthen U.S. production of industrial materials now dominated by China.

He also pledged close coordination with Washington on a second tranche during Takaichi’s planned visit to the United States in March.

The structure of the package reflects Washington’s priorities. As AI expansion strains power grids and geopolitical tensions reshape supply chains, energy infrastructure and critical materials have become central to U.S. economic security.

Rather than broad pledges, Tokyo presented projects that directly address these bottlenecks, reinforcing its position as a strategic partner.

Korea left behind

The fast and systematic move by Tokyo has placed Korea in a laggard position.

Seoul has announced plans for large-scale U.S. investments in nuclear power, shipbuilding, energy and advanced manufacturing. However, progress has been slowed by legislative delays and the absence of a comprehensive institutional framework.

The National Assembly’s special committee on U.S. investment has yet to complete key groundwork, including passage of a special law to support overseas investment programs. Instead of forging consensus around a national strategy, political wrangling and blame-shifting have continued.

Opposition People Power Party lawmaker Kang Seung-kyu criticized the government and ruling party for what he called their unilateral approach.

“They cannot blame the People Power Party for the delay of the Special Act on Investment in the United States while they are pushing through other bills on their own,” he said.

The ruling party, meanwhile, has repeated that the deal could undermine Korea’s competitiveness, without presenting a concrete strategy for securing favorable terms.

“Automobile tariffs directly affect a large number of jobs in Korea,” Lee Un-ju, a Supreme Council member of the Democratic Party of Korea, said. “If Korea faces higher U.S. tariffs than Japan, Korean automobiles will lose competitiveness in the American market.”

She added that as many as 1.5 million people depend directly or indirectly on the auto industry, stressing that “further parliamentary deadlock cannot be tolerated.”

Washington’s expectations

Yet the auto sector is not at the center of the investment framework Washington expects from Seoul.

In the investment list posted on the White House website, Korea’s commitments are categorized mainly under energy and environment. Individual companies such as Hyundai Motor Group and Hanwha Ocean are expected to pursue separate manufacturing investments.

Japan’s package combines infrastructure development, corporate participation and diplomatic engagement into a single framework. Energy projects resolve immediate bottlenecks, Japanese firms secure long-term roles, and political ties are reinforced.

By contrast, Korea’s approach remains fragmented. While Seoul has outlined cooperation in energy, semiconductors and AI, it has yet to consolidate these initiatives into a unified package backed by legislation and long-term financing.

U.S. officials have repeatedly emphasized that energy security, export capacity and supply-chain diversification are central to future cooperation. Countries that can deliver these elements in integrated form are better positioned in trade and tariff negotiations.

Structure over scale

The government has moved to accelerate talks, dispatching a working-level delegation to Washington this week to explore projects in nuclear power, shipbuilding and advanced industries. Ruling party leaders are also seeking ways to pass investment-related legislation despite opposition resistance.

However, experts note that without a stable legal and fiscal framework, such efforts may appear provisional.

Japan’s advantage lies not only in speed but in structure. Its investment package links public financing, private-sector participation and diplomatic coordination into a single system.

For Korea, the challenge is to move beyond ad hoc negotiations and build similar institutional foundations — integrating power infrastructure with AI and semiconductor projects, energy investment with shipbuilding orders, and mineral supply with downstream processing.

The legislative impasse, she admitted, is not the sole obstacle.

“The Ministry of Land, Infrastructure and Transport and the Ministry of Trade, Industry and Resources are engaged in turf wars and passing the buck, which has stalled progress,” she said.

For now, Seoul faces a growing list of homework, while Tokyo continues to earn points — and advance its national interests — in Washington.

Copyright ⓒ Aju Press All rights reserved.