A series of multibillion-won deals and soaring biosimilar penetration rates now signal that Korean firms are reshaping competitive dynamics in Asia's largest and most defensive drug market.

Samsung Biologics, the world's largest CDMO by production capacity, has secured its biggest annual order volume to date and is now servicing nearly half of Japan's top 10 drugmakers.

"We have already signed contracts with four of Japan's top 10 pharmaceutical and bio companies, and we are in final-stage discussions with one more," CEO John Rim said on the sidelines of Bio Japan 2025 in Yokohama on Oct. 8, adding that the company will continue strengthening its pipeline of Japanese clients on the back of its global competitiveness.

Rim highlighted mass-production efficiency, broad modality capabilities, and high-quality manufacturing standards as core assets enabling the company to win contracts in Japan and across Asia.

Samsung Biologics has also gained exceptional regulatory traction, securing 18 manufacturing approvals from Japan's Pharmaceuticals and Medical Devices Agency — 12 of them in the last three years — an achievement that has deepened confidence among Japanese innovators.

The Incheon-based CDMO's orderbook has swelled in parallel, reaching 5.6 trillion won, up fivefold from 1.16 trillion won in 2021. Recent deals include a 275.9 billion won contract extension with a European pharmaceutical partner and a 76.5 billion won agreement with an Asian client announced in early November.

Celltrion, meanwhile, has achieved one of the rarest feats in global pharmaceuticals: dominating Japan's biosimilar market against originators such as Roche, Sandoz, Pfizer, and Amgen.

Its breast and gastric cancer biosimilar Herzuma commands more than 75 percent of Japan's market — surpassing the original product since 2021 — according to Iqvia. Vegzelma, a biosimilar for colorectal and lung cancer introduced as a late entrant, has secured roughly 53 percent market share.

The growth trajectory is steep: Herzuma rose from 2 percent market share in 2019 to 30 percent in 2020 and 50 percent in 2021, while Vegzelma tripled from 15 percent last year to over 50 percent in 2024.

In autoimmune disease treatments, spanning rheumatoid arthritis to ulcerative colitis, Celltrion's Remsima holds 43 percent share and Yuflyma 15 percent — both ranking first among biosimilars in Japan.

"All products currently sold in Japan are delivering overwhelming results, demonstrating Celltrion's differentiated marketing capabilities and product competitiveness," said Senior Executive Vice President Kim Ho-ung.

He added that the company plans to sequentially launch follow-up products, including Remsima SC, next year to further reinforce sales and profitability.

Although Celltrion does not disclose Japan-specific revenues, its local unit Celltrion Healthcare Japan recorded 62.9 billion won in sales last year, making the group the largest Korean pharmaceutical exporter to Japan.

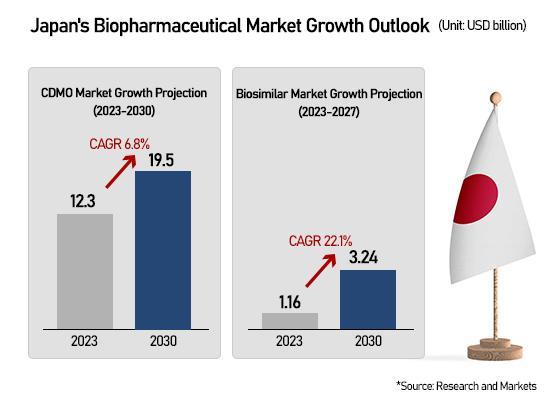

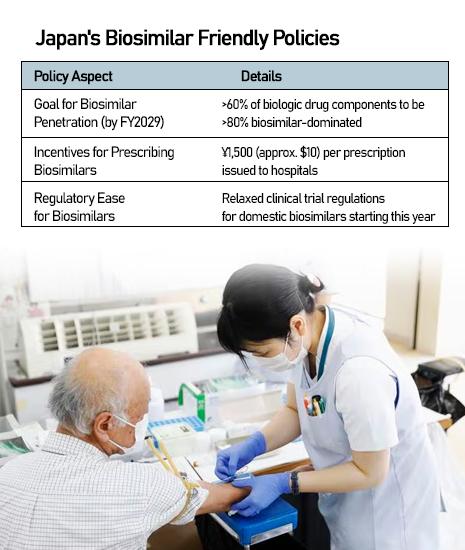

Japan, the world's third-largest pharmaceutical market, has been notoriously difficult to penetrate due to strict regulations, conservative prescription patterns, and loyalty to domestic brands.

Experts say Korean players succeeded by tailoring strategies to Japan's ecosystem — local subsidiaries, customized sales operations, and alignment with government policies encouraging wider biosimilar adoption.

SK Biopharmaceuticals' partner Ono Pharmaceutical submitted a new drug application in September for epilepsy treatment Cenobamate to Japan's PMDA, targeting approval in the second half of 2026. Japan is the world's second-largest epilepsy market after the United States, with roughly one million patients.

GC Biopharma also received PMDA approval in August 2024 for a Phase 1 clinical trial of GC1130A for Sanfilippo syndrome type A, following investigational new drug approvals in both Korea and the United States. The company has already secured Japanese approval for its Hunter syndrome therapy Hunterase, based on intracerebroventricular delivery.

Despite strong overseas performance, Korean biopharma valuations are facing skepticism at home.

Samsung Biologics' market capitalization — now above 84 trillion won — is being compared critically with Switzerland's Lonza, given Samsung's lower revenue base and more limited capabilities in emerging modalities such as antibody-drug conjugates.

Celltrion, meanwhile, has grappled with governance noise over treasury stock management and repeated shortfalls in revenue guidance. Minority shareholders have even organized a committee to seek an extraordinary general meeting after autoimmune drug Zymfentra significantly underperformed sales expectations.

Copyright ⓒ Aju Press All rights reserved.