SEOUL, Feb 12 (AJP) -Despite a broad retreat in the U.S. dollar, the South Korean won has failed to stage a meaningful recovery, frustrating authorities attempting to break what officials increasingly describe as a cycle of “structural undervaluation.”

According to data released Thursday by the Bank of Korea, the won-dollar exchange rate stood at 1,459.1 as of Feb. 10, marking a 1.4 percent depreciation from December’s average of 1,439.

The decline came even as authorities deployed more than $4.7 billion in foreign exchange reserves over the past two months to stabilize the currency.

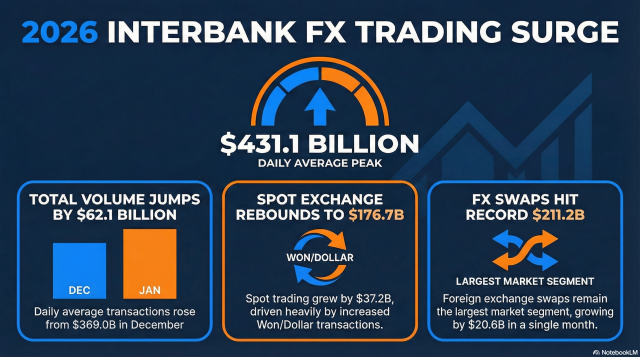

Market data point to clear signs of intervention. Average daily spot turnover jumped by $3.72 billion — from $13.95 billion in December to $17.67 billion in January — a surge widely attributed to official efforts to defend the won.

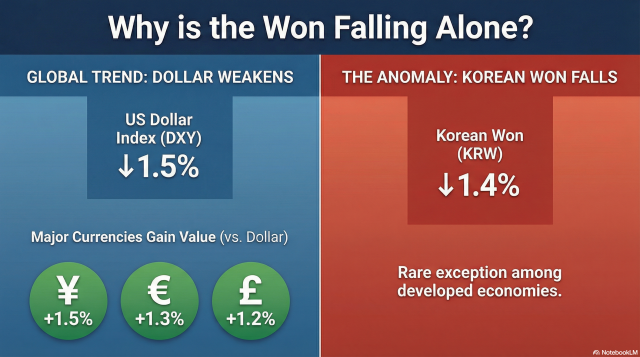

The won’s weakness stands in sharp contrast to global currency trends.

Over the same period, the U.S. Dollar Index (DXY) fell 1.5 percent from 98.3 to 96.8, lifting most major currencies. The Japanese yen strengthened from 156.7 in December to 154.3 as of Feb. 10. The euro and British pound gained 1.5 percent and 1.3 percent, respectively.

Among major advanced economies, the won was the only currency to lose grounds.

The divergence is even starker against emerging markets. The J.P. Morgan Emerging Market Currency Index rose 2.4 percent, from 46.6 to 47.7. The Brazilian real advanced 5.7 percent, the Mexican peso climbed 4.7 percent and the Russian ruble rose 2.2 percent.

Even the Chinese yuan — the only emerging-market currency included in the IMF’s Special Drawing Rights basket — appreciated 1.1 percent despite Beijing’s easing measures. India, the only BRICS member maintaining a weakening trend due to domestic policy easing, saw a modest 0.5 percent depreciation — far smaller than Korea’s decline.

Yet underlying indicators suggest no structural shortage of dollars.

The three-month swap rate — a key gauge of dollar funding conditions — rose 16 basis points from minus 1.48 percent in December to minus 1.32 percent as of Feb. 10, reflecting a narrowing Korea-U.S. interest rate gap. Currency swap rates climbed from 2.6 percent to 2.84 percent during the same period.

The data indicate that the won’s weakness stems more from external sentiment and capital flows than from physical dollar scarcity.

External confidence metrics remain stable. The spread on short-term external borrowing narrowed from 13 basis points in December to 11 basis points in January. Korea’s five-year credit default swap premium edged down from 22 basis points to 21 basis points.

The Bank of Korea pointed to outbound retail flows as a key driver.

Overseas investments by individuals more than tripled from $1.5 billion in December to $4.8 billion in January, the BOK noted, mounting significant upward pressure on the exchange rate.

The pressure was partially offset by the National Pension Service, which reduced its overseas investment target for this year from 38.9 percent to 37.2 percent.

Despite the continued undervaluation, the Korean won showed signs of recovery, gaining 10 to close at 1,446 per dollar on Feb. 11. As of 2:00 p.m. on Feb. 12, the currency climbed an additional 6 to reach 1,440. This rebound comes as foreign investors scooped up 1.6 trillion won in the KOSPI market, driving capital inflows, while authorities are presumed to be continuing their market interventions.

Copyright ⓒ Aju Press All rights reserved.