SEOUL, October 22 (AJP) - Samsung Electronics unveiled its first mixed-reality headset, the Galaxy XR, on Wednesday in South Korea and the United States, entering the spatial computing race as a more affordable alternative to Apple’s Vision Pro and a sleeker model than Meta’s Quest.

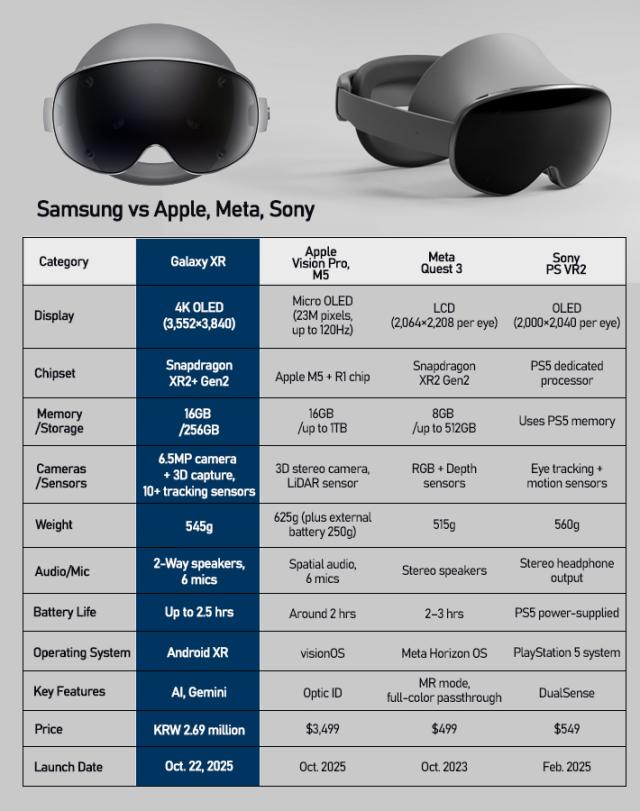

Powered by Qualcomm chipset and Google’s Android XR platform as well as Gemini AI assistant, the Galaxy XR is priced at 2.69 million won ($1,800), about half the cost of the Apple Vision Pro launched earlier this year at $3,499, and roughly four times the price of Meta’s Quest 3 at $499.

Samsung aims to position the device as an accessible yet high-spec option built on its strengths in chip, display, and ecosystem integration. The headset features dual 4K-level screens, eye- and hand-tracking sensors, and Qualcomm’s Snapdragon XR2+ Gen 2 processor. It supports multimodal AI input through voice, gaze, and gestures, powered by Google’s Gemini AI embedded into the device.

Weighing 545 grams, it is slightly lighter than Apple’s Vision Pro at around 600 grams but heavier than Meta’s Quest 3. Samsung said it worked with Google to ensure native support for YouTube XR, Google Maps, Photos, and Play Store apps adapted for spatial use, and plans to release developer kits by the end of the year.

Unlike Apple, which relies on its own silicon and software stack, Samsung partnered with Google and Qualcomm to build the Galaxy XR. Industry analysts say this approach could help speed up app availability but may limit Samsung’s control over the user experience and long-term software updates.

“We have been working together at every layer—hardware, software, and how the product comes to market—as one team building a new platform and a new product,” said Juston Payne, director of XR management at Google.

Apple’s Vision Pro uses dual 4K micro-OLED displays and its in-house M2 and R1 chips to process spatial video, hand tracking, and eye input, and supports more than 2,000 optimized apps as of September 2025. Meta’s Quest 3, while less powerful, leads global shipments with more than 20 million cumulative unit sales, thanks to its large gaming ecosystem and lower price point.

According to industry tracker IDC, about 12 million headsets are expected to ship worldwide in 2025, with Meta holding over 50 percent of the market, followed by Apple at around 15 percent. Samsung has not disclosed shipment targets for the Galaxy XR.

Analysts say the key test for Samsung will be whether it can extend XR applications beyond gaming and entertainment. The company has signed an agreement with Samsung Heavy Industries to use XR for shipbuilding and engineering training and has conducted pilot programs in medical education.

Demand for Apple’s Vision Pro remains largely confined to the United States and China, while Meta dominates the mass market but earns little profit from hardware sales. Samsung, by contrast, is targeting professional training, design collaboration, and industrial simulation as potential growth areas.

The Galaxy XR will begin shipping in early 2026. Whether Samsung can challenge Apple’s dominance at the high end and build a profitable XR ecosystem will depend on app availability, battery performance, and whether consumers see headsets as daily-use devices rather than novelties.

The initial response is lukewarm. “People already own phones, tablets, and laptops. I’m not sure it’s worth spending that much money on another device just yet,” said Kim Yeon-ji, 34. Another prospective buyer, Lee Jong-min, 35, said, “I’ve always wanted to try XR, and I’m curious about it. I plan to try it as soon as it becomes available.”

Copyright ⓒ Aju Press All rights reserved.