SEOUL, Feb. 05 (AJP) - “What goes up must come down,” the saying goes — and after a prolonged roller-coaster ride, Korean stocks plunged Thursday as heavy institutional selling triggered a sharp reversal.

The immediate cue came from a retreat in U.S. technology shares. But the pullback was hardly unexpected, given the rapid buildup in short-selling positions and growing signs of speculative excess.

Both the KOSPI and the secondary KOSDAQ tumbled nearly 4 percent Thursday from their previous day’s peaks, underscoring how quickly sentiment had shifted.

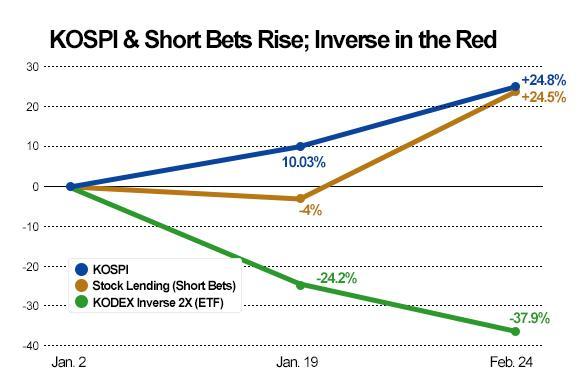

The reversal had been foreshadowed by institutional investors’ readiness to lock in profits at the first sign of weakness. As of Tuesday, the balance of stock lending — widely seen as a precursor to short selling — climbed to a record 140.8 trillion won ($96 billion), up 24.5 percent from six months earlier, according to market data.

In stock lending transactions, institutional players such as pension funds and insurers lend shares to traders, who sell them in anticipation of repurchasing them later at lower prices. The expanding lending balance suggests a growing number of investors have been positioning for a correction or seeking protection against heightened downside risks.

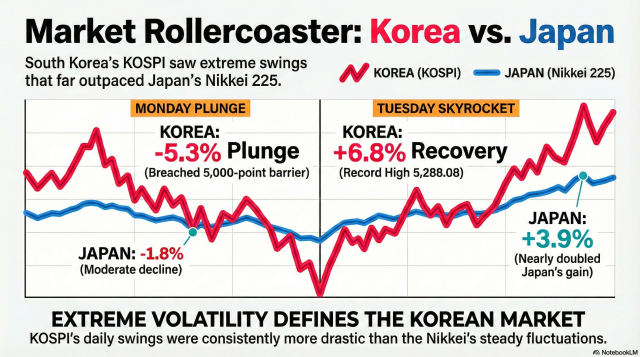

Market volatility in early February has been unusually intense. On Monday, concerns over a potential hawkish shift in U.S. monetary policy triggered a 5.3 percent plunge in the KOSPI, briefly pushing it below the psychologically important 5,000 mark.

The index rebounded sharply the following day, surging 6.84 percent to a record close, before extending gains on Wednesday — only to reverse course again.

By comparison, Japan’s Nikkei 225 posted far more moderate fluctuations over the same period, highlighting the exceptional turbulence in Korean equities. Reflecting elevated investor anxiety, the VKOSPI volatility index climbed above 50 on Feb. 5, more than 50 percent higher than a month earlier.

“As volatility widens and the market appears increasingly disconnected from economic fundamentals, investors are actively seeking hedging tools,” a market official said, speaking on condition of anonymity.

Yet products designed to profit from falling markets have struggled as the rally continues.

Samsung Asset Management’s KODEX 200 Futures Inverse 2X ETF — the most actively traded inverse product — closed at 345 won on Feb. 4, down 38 percent over the past month and more than 90 percent below its 2016 listing price, leaving it trading at levels comparable to penny stocks.

Other inverse products have also weakened. Mirae Asset’s TIGER Inverse ETF has fallen about 22 percent since the start of the year.

Inverse ETFs move opposite to the underlying index, meaning their performance deteriorates when markets rise. When the KOSPI fell 3.86 percent in the following session, the KODEX leveraged inverse fund briefly jumped nearly 9 percent, underscoring the products’ sensitivity to market swings.

Analysts say structural factors also weigh on returns, including frequent trading and retail investors’ tendency to react quickly to market headlines.

Average daily ETF trading value this year has nearly doubled from last year to more than 11 trillion won, according to the Korea Exchange, reflecting heavier speculative activity. The Bank of Korea has also noted rising trading volumes in leveraged and inverse ETFs.

“Participants in leveraged and inverse ETF markets, especially double-inverse products, tend to focus on short-term trades and are highly sensitive to external news,” said an official at a capital markets research institute.

Copyright ⓒ Aju Press All rights reserved.