SEOUL, January 07 (AJP) - South Korean technology producers that rely on both China and Japan for critical raw and intermediate inputs may find themselves caught in the crossfire of rising U.S.–Japan tensions, after Beijing imposed sweeping export restrictions on more than 1,000 so-called “dual-use” items bound for Japan.

China announced a blanket ban on the export of dual-use goods to Japan while hosting South Korean President Lee Jae Myung for a state visit and summit with Chinese President Xi Jinping. Although framed as a measure to prevent “military use,” the restrictions include seven types of heavy rare-earth elements (HREEs) and permanent magnets essential to advanced manufacturing, making it one of Beijing’s most aggressive trade actions against Tokyo to date.

The impact, however, is unlikely to stop at Japan. Because South Korea depends heavily on Japanese intermediate goods for its core semiconductor and battery industries, disruptions along the China–Japan supply chain could ripple quickly into Korea.

Heavy rare earths at the choke point

At the center of the issue are heavy rare-earth elements, often described as the “vitamins of the high-tech industry.” Compared with light rare earths, HREEs offer stronger magnetic properties, higher heat resistance and superior performance in optical signal processing — making them indispensable for semiconductors, electric vehicles and defense-related technologies.

China holds a near-monopoly over these materials, accounting for more than 60 percent of global HREE mining output and refining about 95 percent of all rare earths produced worldwide. It also controls over 90 percent of global permanent magnet production.

This concentration raises particular risks for South Korea’s export-driven tech sector, especially semiconductors and electric vehicles.

Korean chipmakers remain more than 90 percent dependent on Japanese-made extreme ultraviolet (EUV) lithography equipment, supplied by firms such as Tokyo Electron. The production of this equipment is virtually impossible without yttrium (Y), a key heavy rare earth now caught up in China’s export controls.

The electric vehicle sector faces similar exposure. Korean EV manufacturers rely heavily on Japanese-made power integrated circuits that regulate energy flow from batteries to motors. Producing these components requires stable supplies of gallium (Ga), germanium (Ge) and graphite (C) — materials over which China maintains tight control across the global supply chain.

Caution amid uncertainty

Despite the mounting concerns, some experts warn that excessive alarm may be premature, as details of the export ban remain unclear.

“While the term ‘comprehensive ban’ sounds severe, the absence of a finalized item list suggests this could still be a low-level maneuver,” said Park Han-jin, a special professor at Hankuk University of Foreign Studies and a former China head at KOTRA.

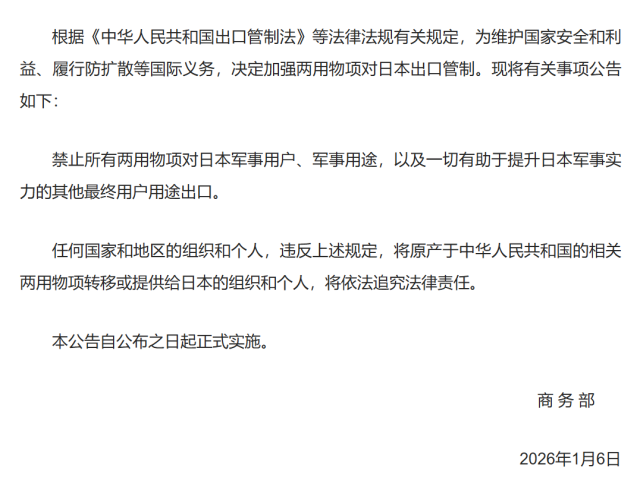

An official notice, he noted, would normally specify the legal authority, exact items covered and enforcement rules. So far, the announcement from China’s Ministry of Commerce has remained broad and procedural, in contrast to Beijing’s 2023 restrictions on germanium and gallium, which were authorized directly by Xi through a presidential decree.

An official at South Korea’s Ministry of Trade, Industry and Energy, speaking on condition of anonymity, also said it was too early to assess the direct impact on Korean firms.

Still, the warning lights are flashing. “At this stage, it appears to be a pressure tactic aimed at discouraging Japan from deeper involvement in the Taiwan issue,” Park said. “But if rare earths are fully included in the ban, the shock could hit Korea’s core exporters hard.”

Copyright ⓒ Aju Press All rights reserved.